How Many Hours Americans Need to Work to Afford a Home

When it comes to the cost of living in cities, a general rule of thumb is that housing prices are much higher in the country’s economic and population hubs, especially in the cities along the coasts.

Particularly in recent years, prices have been pushed sky-high in places like New York City or San Francisco through a combination of limited supply of new homes, increasing demand, shifting demographics, and government regulations.

PUTTING IT INTO PERSPECTIVE

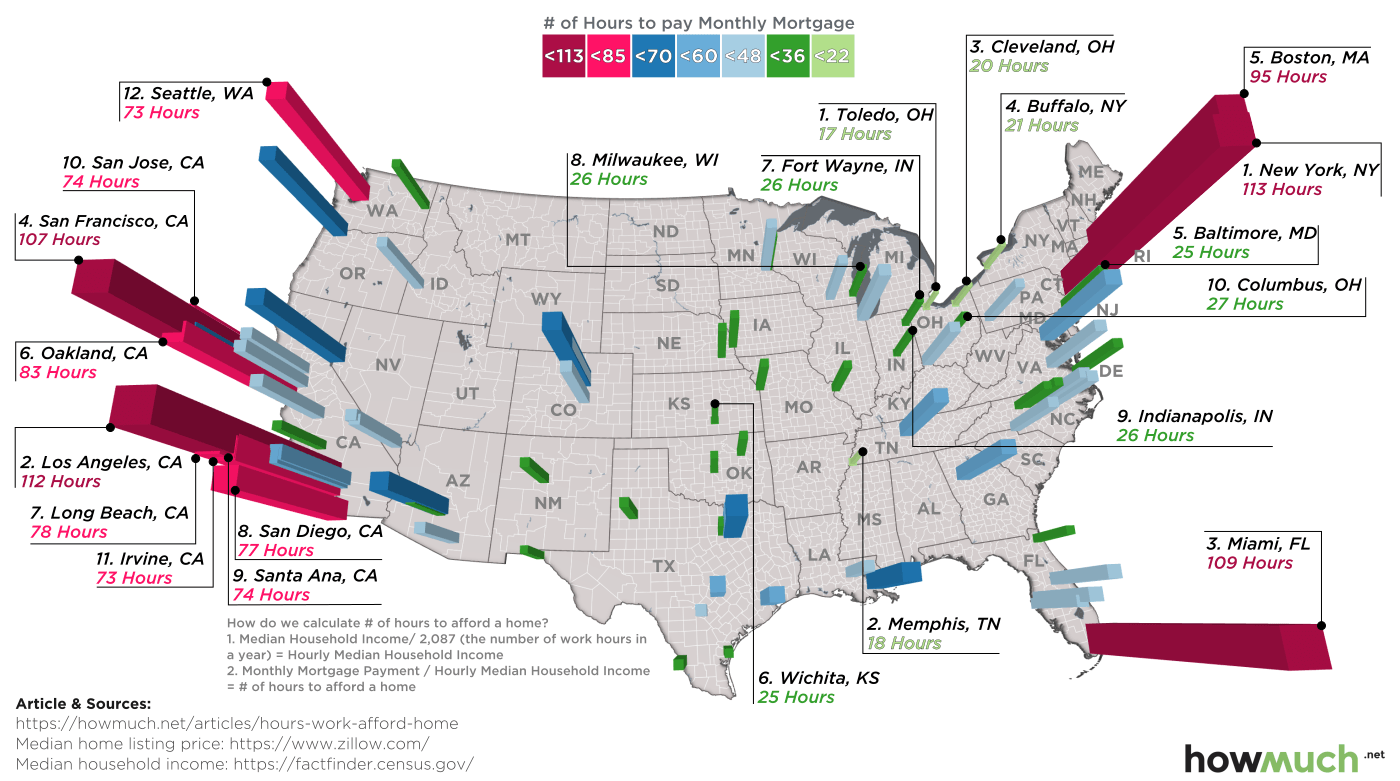

Today’s visualization from HowMuch.net applies a common denominator to compare 97 of the biggest cities in the United States. Using a measure of median household income against the average mortgage payment in each city, we get a gauge of how many hours must be worked each month just to pay down the house.

The visualization uses data from the U.S. Census for household income and Zillow for median home listing price, while calculating mortgage payments based on a standard 30-year term.

THE RESULTS

Using the above method to compare the amount of hours it takes to pay down a monthly mortgage, we see some interesting contrasts in the country.

Here are the five most expensive cities in the United States for housing:

With about 170 hours in a normal work month, the average people in these cities are spending 50% or more of their income just to pay down their mortgages. It’s worst in New York City and Los Angeles, where at least 65% of income is going towards housing.

Leave A Comment