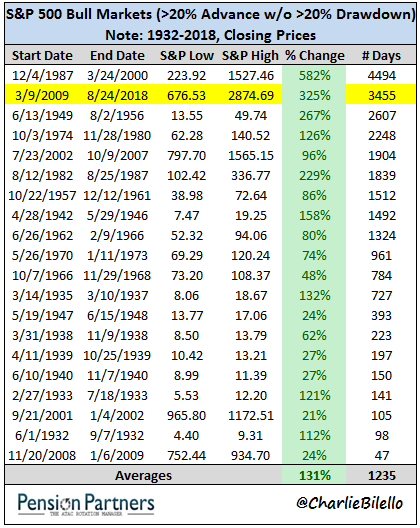

They say it’s the longest bull market ever.

Certainly makes for a good headline, but what does “bull market” mean? And is determining its length of any value for investors? Let’s take a look.

Defining the “Bull”

There is no standard definition for “bull market.” If you ask 10 different market participants you could easily get 10 different answers.

Many say it’s a 20+% rally in stocks that continues indefinitely until there’s a 20% decline. Why 20% and not 19% or 21%? Who knows. We like round numbers and someone decided years ago that 20% was as good as any barometer. Over time it caught on.

But how should one measure the 20% moves?

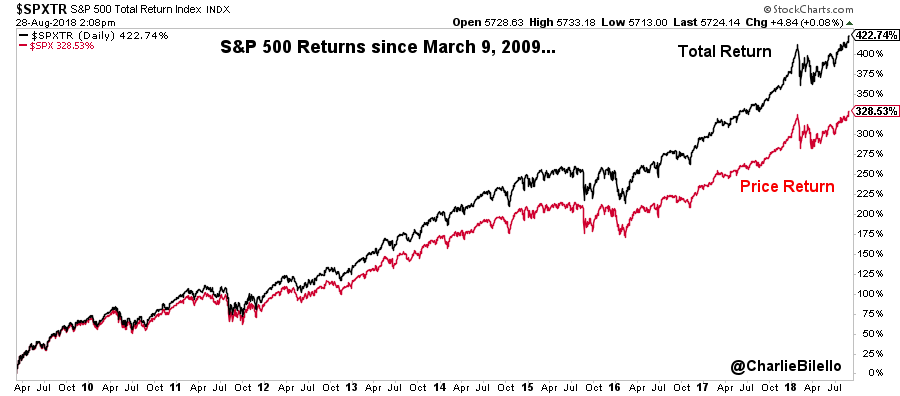

a) Should you use price returns or total returns (including dividends)? Most use price returns, ignoring the large differences that dividends can make over time.

This is true on the upside.

The S&P 500 Index is up 328.5% since March 9, 2009. Including dividends, it is up 422.7%.

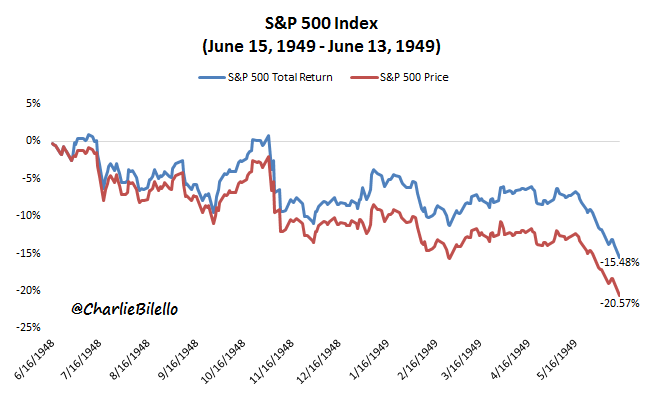

And on the downside…

If you include dividends, the “bear market” from June 1948 to June 1949 is magically erased (dividend yields averaged over 5% during this time).

Data source: Bloomberg

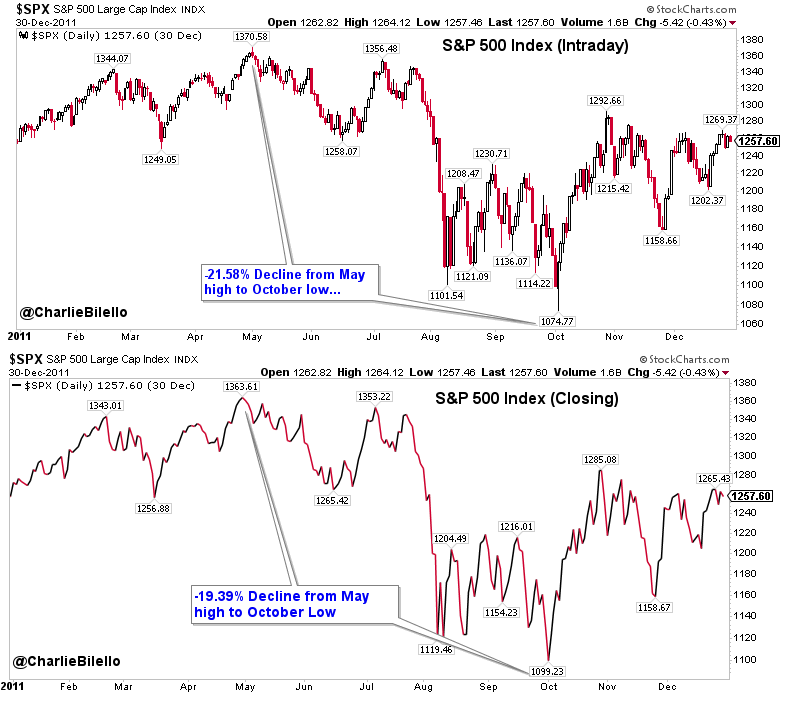

b) Should you use closing prices or intraday prices? Most use closing prices, but if they used intraday prices the current bull market would have ended in October 2011.

The same is true for the declines in 1990 and 1998 that fell just short of 20% on a closing basis but exceeded 20% intraday. The articles claiming that this is the “longest” bull market ever seem to be ignoring this fact, arbitrarily using intraday prices for 1990 and closing prices for 1998 and 2011.

Using closing prices for all periods, this is the second longest bull market, still trailing the 1987-2000 run by over 1000 days.

c) Should you use the S&P 500 or a broader index such as the Wilshire 5000? Most use the S&P 500 but if they chose the Wilshire the current bull market would have ended in 2011, even if you used closing prices.

Leave A Comment