Written by marcuss

“Tama, how much should I invest in cryptos?”

It’s one of the most common questions I’m asked about cryptocurrencies.

And I get it. A lot of people think cryptos are in a big bubble. They’re some of the most volatile asset markets have ever seen. And with so many different types of cryptos out there, it can be hard to know how much of your portfolio you should allocate to any one of them.

So today, I’m clearing up the confusion…

Start small

The first thing to keep in mind when you’re investing in cryptos is to start small. And when I say small, I mean with a few hundred bucks. (Remember that you can buy a fraction of a bitcoin… the minimum lot size is not one bitcoin.)

Using a small sum, get used to the process of transferring, trading and safely storing cryptos. Once you’re comfortable, then you can start to level up to bigger sizes.

You see, the process of buying, moving and storing cryptos it is not like traditional online banking or investing. In the world of crypto, if you make a mistake you can lose your money in an instant. If you send bitcoin to the wrong address, it’s gone. That’s it. There’s no recourse. And there are very few, if any, “I forgot my password” options in the crypto world. So it’s critical to familiarise yourself with the mechanics of buying crypto and moving it around first with a relatively small sum, before moving on to larger dollar amounts.

Never invest more than you can afford to lose

By that I mean, if you woke up tomorrow and your entire crypto portfolio was worthless, you’d be fine financially. It would sting of course, but it wouldn’t be ruinous or anywhere close. So be conservative.

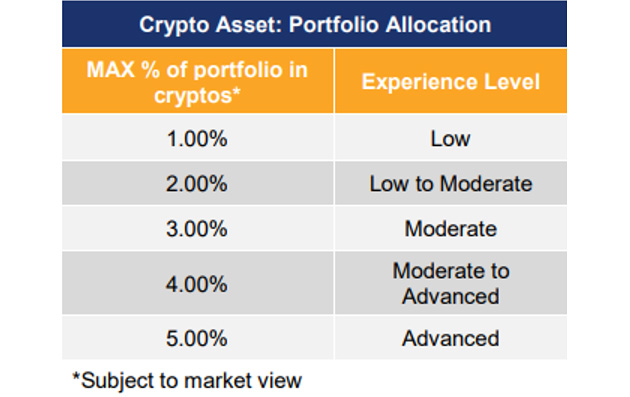

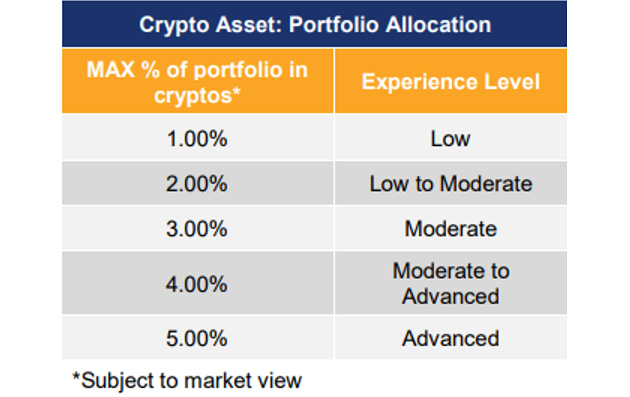

The table below is a very general portfolio allocation guide…

Now, before I get a slew of angry emails, let me point out that the left-hand column denotes the MAXIMUM PERCENTAGE of a portfolio that should be invested in cryptos depending on your experience AND your market bullishness.

Leave A Comment