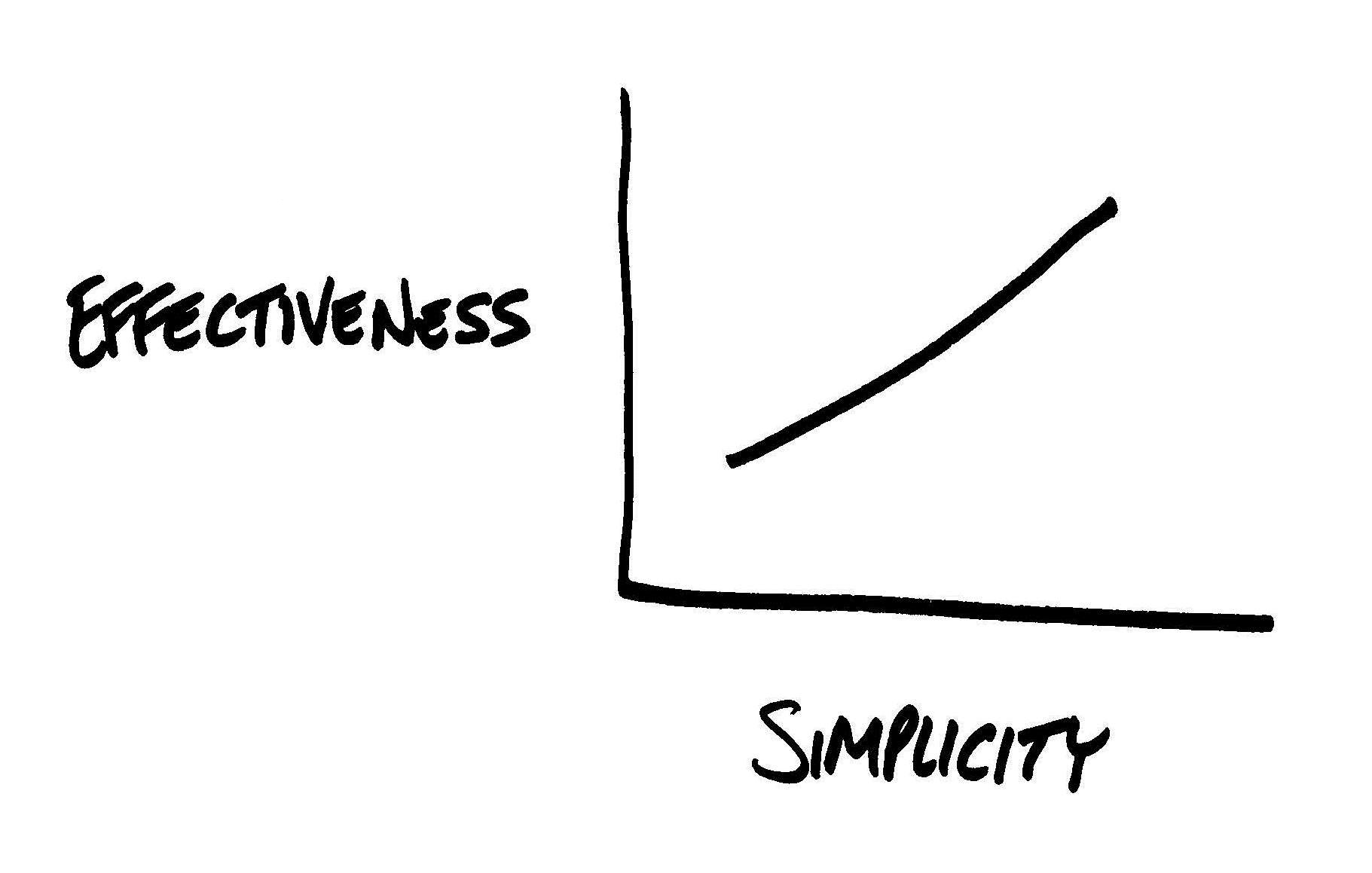

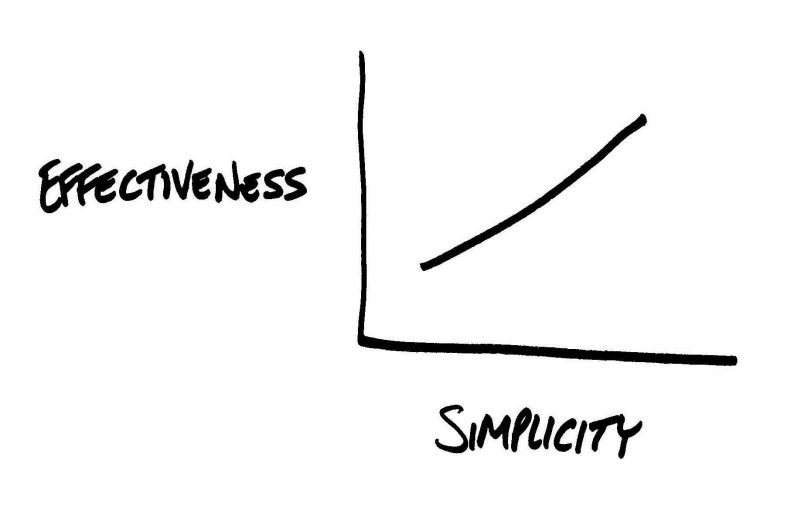

In the age-old dichotomy between simplicity and complexity, the former has been shown time and time again to be the better strategy.

Some of the truly great minds of history agree:

“Everything should be made as simple as possible, but not simpler.”

– Albert Einstein

“Life is really simple, but we insist on making it complicated.”

– Confucius

“Truth is ever to be found in simplicity, and not in the multiplicity and confusion of things.”

– Sir Issac Newton

“Simplicity is the ultimate sophistication.”

– Leonardo da Vinci

We feel the same is true when analyzing businesses in order to find great stock investment opportunities.

The Impressive – But Unfriendly – World of Typical Stock Analysis

There are a lot of places out there you can find individual stock analyses. SA is one of the largest (here’s our profile). You can also find really detailed stock analyses from multiple other sources as well.

We’re not here to knock on these productions. Many of these analyses are detailed, filled with charts and facts, laden with the latest market projections. For some investors, this is what they want – as much detail as humanly possible.

But there are some problems here, as well.

For one, too much detail can lead to a “forest for the trees” issue.

For example, think back to late 2012. Facebook (FB) had gone public mid-year, but had quickly declined from the high $30’s to down below $20. The business media was widely touting it as a “busted IPO”. Revenue growth slowed dramatically, from 88% in 2011 to 37% in 2012. The narrative was that Facebook could not do mobile, and Internet traffic was quickly moving in that direction.

Many detailed analyses of the stock at this time made this the conclusion, projecting continuing slowing revenue growth as people abandoned Facebook’s desktop site and many of its sources of revenue at the time, like online games.

Leave A Comment