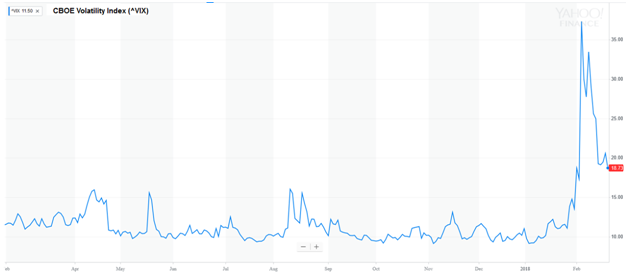

Ah volatility, we thought you were gone. But how quickly you came back:

Source: Yahoo Finance

Nowhere To Hide

There really was nowhere to hide during the latest downturn. Very similar to 2008/2009, most assets were correlated and fell together. But also just like in the 2008/2009 downturn, some equities were less volatile than others.

I frequently discuss dividend growth stocks on this website and I still believe they are the best way to retire stress-free and to weather major market downturns. One of my favorite ways to gain exposure to solid dividend growth stocks is through the Vanguard Consumer Staples ETF (VDC) and the Vanguard Dividend Appreciation ETF (VIG). Not only are these ETF less volatile than many other stock funds, they also have extremely low fees.

Buying Individual Dividend Payers?

If you as an investor are more interested in individual dividend-growth stocks, this is fine too. I have been a big proponent of Procter & Gamble (PG), Altria (MO), and Johnson & Johnson (JNJ) for years now. Let’s compare how they did during the most recent downturn:

Price Change 1/26 – 2/8

S&P 500

-10.1%

Procter & Gamble

-8.5%

Altria

-9.8%

Johnson & Johnson

-13.0%

Source: Yahoo Finance

Let’s also take a look at how they did in the large downturn in 2008:

Price Change Jan. 2008 – December 2008

S&P 500

-32.7%

Procter & Gamble

-13.5%

Altria

-2.8%

Johnson & Johnson

-2.5%

Source: Yahoo Finance

It shouldn’t be too surprising that solid dividend payers are less volatile over time since dividends represent a large portion of their overall return. Because dividend payments are more stable than price growth, this makes total sense.

Leave A Comment