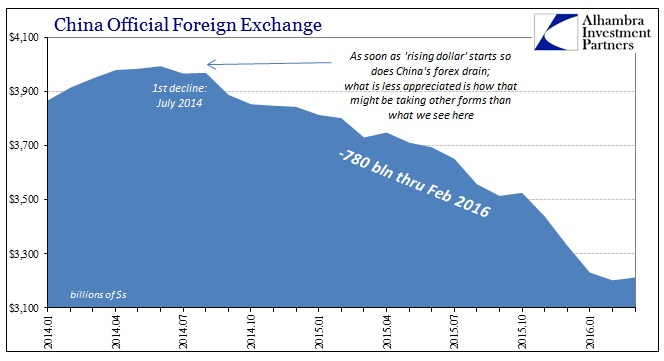

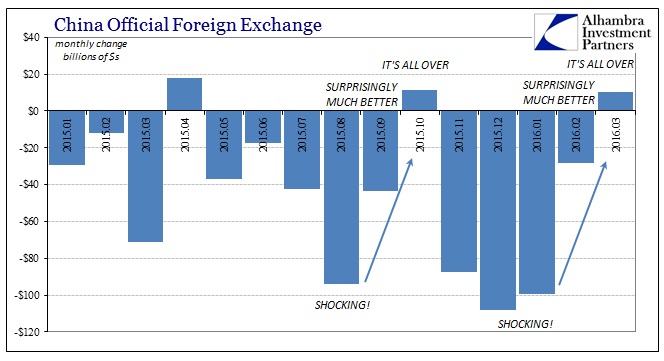

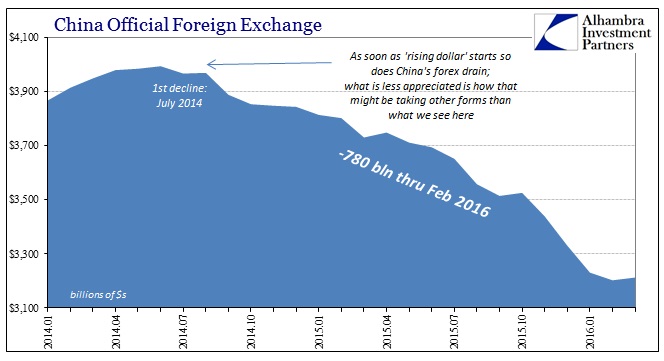

China’s official reported reserves rose in March for the first time in five months. Though reserves had fallen to barely $3.2 trillion in February, that was down just $28.6 billion from January, being already hailed as a success and a step in the right direction since that was less than a third of the shocking decline in January (-$99.5 billion). The increase in March was small (+$10.3 billion), but given the months preceding it that was enough to really unleash “the narrative” especially since it was assumed as continued improvement two months running.

Capital outflows from China have moderated, according to recent official data, in part helped by expectations the Fed will slow the pace of interest rate rises this year. Federal Reserve Chair Janet Yellen’s comments last week that the U.S. central bank should proceed cautiously in adjusting policy have caused a broad-based retreat in the dollar…

The central bank reported its net foreign exchange sales fell sharply to 228 billion yuan ($35.2 billion) in February, down from 644.5 billion yuan in January, a sign of decreased government intervention in support of the yuan.

There isn’t anything in those quoted paragraphs (or the entire article, for that matter) that I agree with. First and foremost, there is absolutely no awareness that this is simple repetition – and almost exact repetition at that. It’s not enough to realize that we have seen this before, but the last three months are an almost exact replay of August-September-October.

The three monthly flows January thru March were: -$99.5 billion, -$28.6 billion, +$10.3 billion. The three monthly flows August thru October were: -$93.9 billion, -$43.3 billion, +$11.4 billion. And with that positive “inflow” in October, all the same pronouncements as were made above were issued then.

China’s massive foreign-exchange hoard rose in October, snapping a five-month streak of capital outflows in a development that could help Beijing shore up the value of its currency.

The rise reported by the central bank on Saturday follows five consecutive monthly declines. It indicates weakening investor expectations of a depreciating yuan and Beijing’s successes in stemming the outflow of illegal money transfers out of the country.

Leave A Comment