Illinois Tool Works Inc. (ITW) manufactures and sells industrial products and equipment worldwide. It operates through seven segments: Automotive OEM; Food Equipment; Test & Measurement and Electronics; Welding; Polymers & Fluids; Construction Products; and Specialty Products. Illinois Tool Works is a dividend champion with a 44 year track record of annual dividend increases.

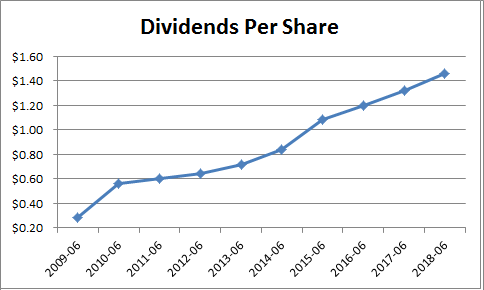

Back in August, the company’s Board of Directors authorized a 28 percent increase in the dividend payout to shareholders. This brought the quarterly dividend to $1/share. This action brought the stock to my radar.

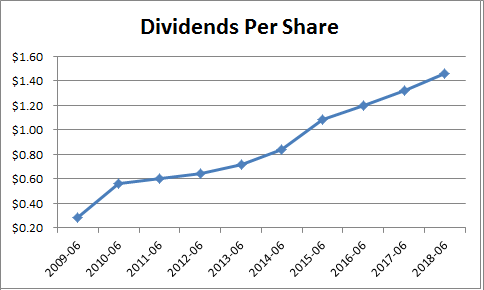

The company has a ten year dividend growth rate of 11.60%/annum. Rather than pursue lower-return, higher-risk opportunities that reside outside of the company’s core strengths and capabilities management has chosen to return surplus capital to its shareholders. This is the type of return focused and shareholder-friendly management I like to see.

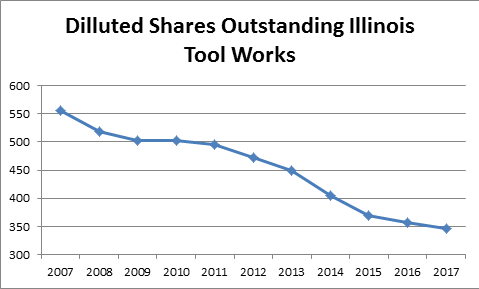

The company has reduced the number of shares outstanding from 556 million in 2007 to 347 million in 2017. This is a 38% decrease in shares outstanding over the past decade, or a reduction of 4.30%/year

The Board also approved a new share repurchase program that authorizes management to buy back up to $3 billion of the company’s common stock over an open-ended period of time. The full authorization represents approximately 22 million shares, or 6% of shares outstanding.

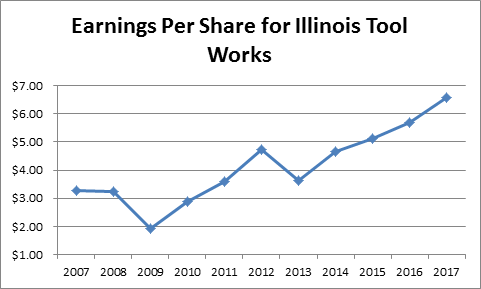

Over the past decade, the company has managed to increase earnings from $3.28/share in 2007 to $6.56/share in 2017. The 2017 earnings per share amounts were adjusted for $1.70/share charge related to the new tax law. Illinois Tool Works is expecting to earn somewhere between $7.50/share to $7.70/share in 2018.

The company is in the middle of a restructuring that started in 2013. The goal was to simplify the business structure, narrow the focus and improve the quality of the portfolio, and ultimately focus on organic growth rather than growth through acquisitions. By simplifying and shedding areas that are more commoditified, the company has been able to boost profit margins. This realignment has been helpful in driving organic growth by focusing on most profitable segments, while simultaneously reducing the cost structure.

Leave A Comment