by Dirk Ehnts, Econoblog101

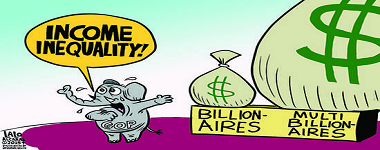

More than five years ago (actually, six) I had wondered whether it is a coincidence that inequality in the US hit a peak in 1929 and 2007. While I did not have time to follow-up on this with an academic paper, Christian Belabed of the IMK just did.

Here is his abstract:

There is a growing literature comparing the current financial crisis or Great Recession to the worst economic crisis of capitalism, the Great Depression. However, the role of rising income inequality, which has risen dramatically before both crises, is rarely discussed. In this paper we discuss the rise of top-end inequality and its effects on household consumption, saving, and debt for the 1920s by applying a non-standard theory of consumption, the relative income hypothesis, to the period of interest. We argue that income inequality is linked to the increase of household consumption and the simultaneous decline of household savings as well as rapidly increasing household debt. Thus, the rise of top-end inequality in connection with a broader institutional change, such as the deregulation of financial markets, has contributed to a build-up of financial and macroeconomic instability, in the period leading to the Great Depression.

The paper finds that households financed consumption through debt, which connects to the story of Thorstein Veblen on conspicuous consumption. Let’s not forget that the US experience a real estate and stock market bubble that both burst in 1929 and the following years. So, the build up of private sector debt papered over a structural weakness in demand that probably was rooted in the income inequality of the Roaring 20s. Interesting result, especially with a view on today’s situation.

Leave A Comment