Insider buying increased last week with insiders buying $170.5 million of stock compared to $121.15 million in the week prior. Selling on the other hand declined sharply with insiders selling $899.89 million of stock last week compared to $2.12 billion in the week prior.

The recent market turmoil sparked renewed enthusiasm among insiders and generated a large number of interesting insider purchases. Four out of the top five purchases listed below have been on my watch list for some time now.

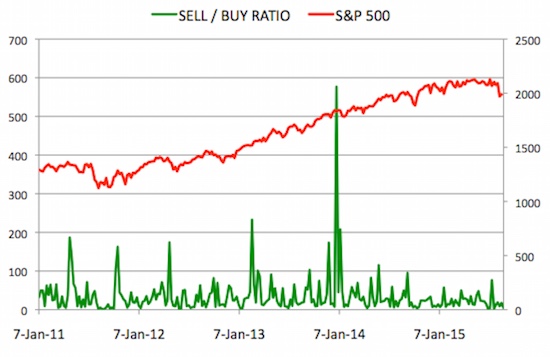

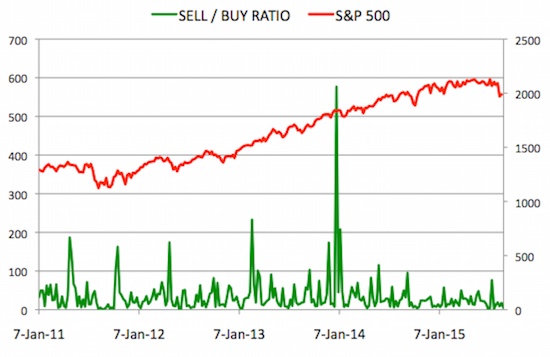

Sell/Buy Ratio: The insider Sell/Buy ratio is calculated by dividing the total insider sales in a given week by total insider purchases that week. The adjusted ratio for last week went dropped to 5.28. In other words, insiders sold more than 5 times as much stock as they purchased. The Sell/Buy ratio this week compares favorably with the prior week, when the ratio stood at 17.47. We are calculating an adjusted ratio by removing transactions by funds and companies and trying as best as possible only to retain information about insiders and 10% owners who are not funds or companies.

Insider Sell Buy Ratio August 28, 2015

Note: As mentioned in the first post in this series, certain industries have their preferred metrics such as same store sales for retailers, funds from operations (FFO) for REITs and revenue per available room (RevPAR) for hotels that provide a better basis for comparison than simple valuation metrics. However metrics like Price/Earnings, Price/Sales and Enterprise Value/EBITDA included below should provide a good starting point for analyzing the majority of stocks.

Notable Insider Buys:

1. DSW Inc. (DSW): $29.02

Executive Chairman Jay L. Schottenstein acquired 500,000 shares of this footwear retailer, paying $28.32 per share for a total amount of $14.16 million. These shares were purchased indirectly by Schottenstein Realty LLC.

DSW posted respectable second quarter earnings with a 7% increase in net sales to $627 million, a 10% increase in earnings to $38 million or 42 cents per share and a 2% increase in same store sales. Yet the stock lounges near its 52 week low despite trading for less than 7 times EBITDA and sporting a dividend yield of 2.66%. The company has a strong balance sheet with no debt and $471 million in short and long-term investments. The stock was down following second quarter results because revenue fell short of analyst expectations and inventory increased to $505 million, a 6.3% increase on a square foot basis.

Leave A Comment