Insider buying more than doubled last week with insiders buying $252.12 million of stock compared to $87.63 million in the week prior. Selling on the other hand decreased with insiders selling $693.93 million of stock last week compared to $825.55 million in the week prior.

We had another volatile week in the equity markets with little overall impact as the S&P 500 ended the week only down 0.81%. Commodities like oil and natural gas however saw continued selling pressure with WTI brent crude down more than 15% to $26.05 on Thursday before rebounding on Friday to close down 4.69% for the week. Gold, in contrast, continues to rally with double digit gains this year as central banks in Japan, Sweden, Denmark and Switzerland have cut interest rates into negative territory. The big concern last week was related to European banks and Deutsche Bank (DB) saw its stock drop significantly early in the week before rebounding towards the end of the week. Weakness in JPMorgan’s stock was also offset by a 8% rally on Friday thanks in part to a $26.59 million purchase by its CEO as discussed below.

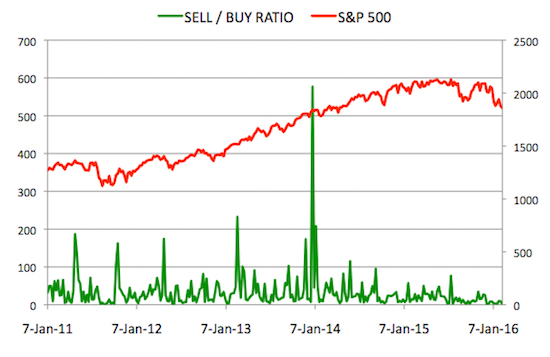

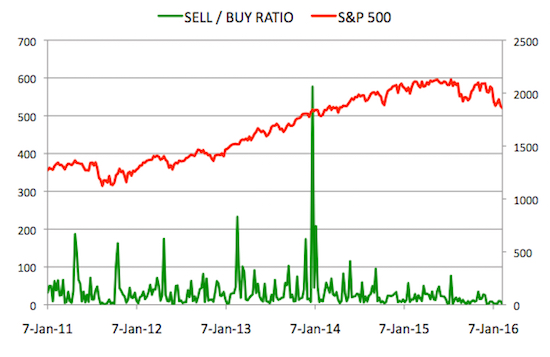

Sell/Buy Ratio: The insider Sell/Buy ratio is calculated by dividing the total insider sales in a given week by total insider purchases that week. The adjusted ratio for last week dropped to 2.75. In other words, insiders sold almost 3 times as much stock as they purchased. The Sell/Buy ratio this week compares favorably with the prior week, when the ratio stood at 9.42. We are calculating an adjusted ratio by removing transactions by funds and companies and trying as best as possible only to retain information about insiders and 10% owners who are not funds or companies.

Note: As mentioned in the first post in this series, certain industries have their preferred metrics such as same store sales for retailers, funds from operations (FFO) for REITs and revenue per available room (RevPAR) for hotels that provide a better basis for comparison than simple valuation metrics. However metrics like Price/Earnings, Price/Sales and Enterprise Value/EBITDA included below should provide a good starting point for analyzing the majority of stocks.

Notable Insider Buys:

1. Tempur Sealy International Inc. (TPX): $54.13

Shares of this bedding products company were acquired by 3 insiders:

Leave A Comment