Insider buying decreased last week with insiders buying $85.92 million of stock compared to $154.2 million in the week prior. Selling on the other hand doubled with insiders selling $2.2 billion of stock last week compared to $1.06 billion in the week prior.

With the market rallying for the third week in a row, insiders appear to be back to their usual pattern of selling a lot of stock and buying very little. We saw remarkable broad-based rallies especially in the beaten down commodities sector and specifically in energy related stocks last week. One offshore oil drilling company, SeaDrill Limited (SDRL), was up as much as 177% on Friday before settling down a little and posting a gain of just 121% for the day. SeaDrill is heavily leveraged and investors were pricing the company for bankruptcy. An energy trader I follow on Twitter said the following after the SeaDrill rally, “Shout out to the chimp who was paying up 170% for the zombie driller 15 minutes ago. It’s a steal now only +115%”. While we have not seen any insider activity at SeaDrill, we did see a small purchase by the CEO of another offshore driller, Atwood Oceanics (ATW) last month.

One of the most interesting footnotes I have seen in an insider filing showed up last week in the purchase filed by the CEO of Exact Sciences (EXAS). Combing through footnotes of SEC filings can often bring up interesting nuggets of information and Michelle Leder of Footnoted built a business by doing exactly that. She eventually sold that business to Morningstar but ended up buying it back from them and went independent again. This Twitter exchange with her explains why the footnote in that filing was interesting and why the stock rallied more than 20% after that filing.

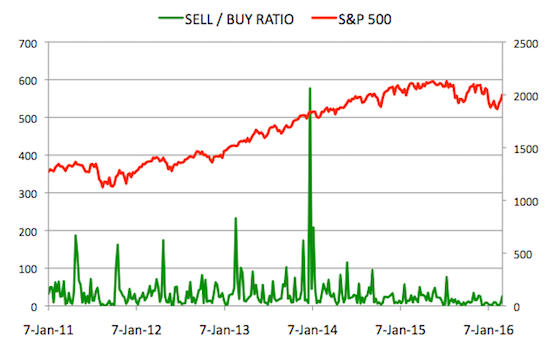

Sell/Buy Ratio: The insider Sell/Buy ratio is calculated by dividing the total insider sales in a given week by total insider purchases that week. The adjusted ratio for last week went up to 25.65. In other words, insiders sold almost 26 times as much stock as they purchased. The Sell/Buy ratio this week compares unfavorably with the prior week, when the ratio stood at 6.85. We are calculating an adjusted ratio by removing transactions by funds and companies and trying as best as possible only to retain information about insiders and 10% owners who are not funds or companies.

Note: As mentioned in the first post in this series, certain industries have their preferred metrics such as same store sales for retailers, funds from operations (FFO) for REITs and revenue per available room (RevPAR) for hotels that provide a better basis for comparison than simple valuation metrics. However metrics like Price/Earnings, Price/Sales and Enterprise Value/EBITDA included below should provide a good starting point for analyzing the majority of stocks.

Notable Insider Buys:

1. Seattle Genetics, Inc. (SGEN): $32.53

Director Felix Baker acquired 675,922 shares of this biotech company, paying $31.77 per share for a total amount of $21.48 million. These shares were purchased indirectly by Baker Bros. Advisors LP.

Leave A Comment