According to the latest EPFR fund flow data compiled by BofA’s Michael Hartnett, the great “institutional to equity” stockholding rotation is accelerating, with another $8.8bn allocated to equities, more than all of it from retail investors, and another $5.8bn going into bonds, offset by a $0.4bn outflows from gold.

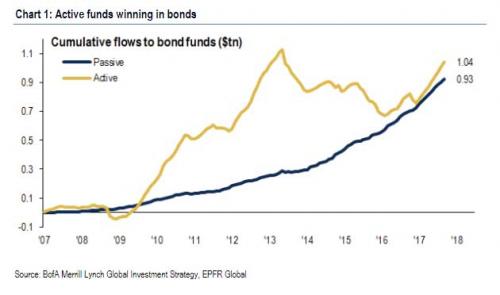

Ironically, the one place where active investors are still putting back at least a token fight against the robots is in bonds, where $3.6bn went into active bond funds this week vs “only” $2.2bn into passive bond ETFs. And, as Hartnett writes, active AUM is fighting back, if only in bondland, where there have been $1.04tn in active bond inflows past 10 yrs vs. $0.93tn into passives…

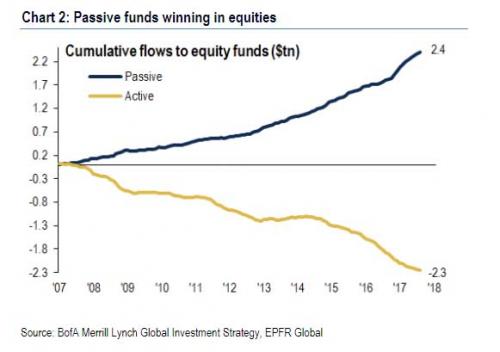

…. a very different trend from what has taken place in stocks in the past decade (Chart 2) where institutions are delighted to dump to “low-cost” passive alternatives.

Of course, this particular “great rotation” is no surprise: earlier this week we were surprised to report that on its conference call, Morgan Stanley reported that the cash levels in its clients (retail) accounts, is the lowest it has ever been:

… we’ve been talking about our deposit deployment strategy for quite sometime, and we’ve been investing excess liquidity into our loan product over the last several years. In the beginning of the year, we told you that, that trend would come to an end. We did see that this year. It happened a bit sooner than we anticipated as we saw more cash go into the markets, particularly the equity markets, as those markets rose around the world. And we’ve seen cash in our clients’ accounts at its lowest level.

Meanwhile, we also showed that institutions continue to sell at a torrid pace, and as BofA reported, in the last week when the S&P hit new all time highs, its clients were net sellers of US equities for the fourth consecutive week. Large net sales of single stocks offset small net buys of ETFs, leading to overall net sales of $1.7bn. Net sales were led by institutional clients, who have sold US equities for the last eight weeks; hedge funds were also (small) net sellers for the sixth straight week.

Leave A Comment