This was another light week of international news, most likely reflecting the “summer doldrums.” The overall pace of activity begins to increase next week as traders return from summer vacations.

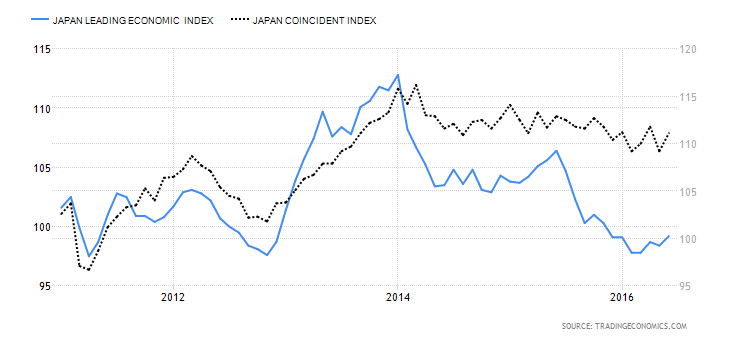

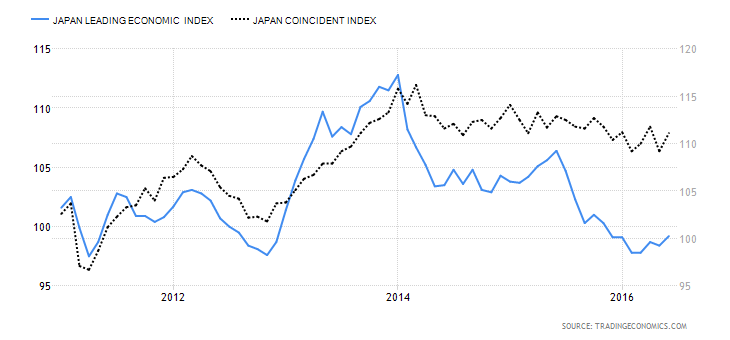

Japanese news continues to disappoint. Although the leading and coincident indicators rose (up .8 and 1.9, respectively) the overall trend for both is still bearish: the LEIs have declined sharply 2 times in the last two years while the CEIs are declining slightly:

Manufacturing is still contracting: the latest reading is 49.6, still below the 50 line the separates readings of expansion from contraction. And inflation is non-existent: CPI decreased .2% M/M and increased a slight .3% Y/Y. All these figures point to an economy that is at best growing slightly.

EU news was positive. Markit’s regional PMI was 53.3, which was a marginal increase of .1 from last month’s reading. This report indicates that the region not only continues to grow but is also somewhat immune to the Brexit’s impact. And loan growing continues to increase, this time at a 1.8% Y/Y rate, continuing this data points the upward trend:

Finally, the UK’s ONS released their second report on 2Q GDP, which increased an unrevised .6%. Household spending was up .9% while capital formation rose 1.4%. However, this was a pre-Brexit number, diminishing its overall impact.

Leave A Comment