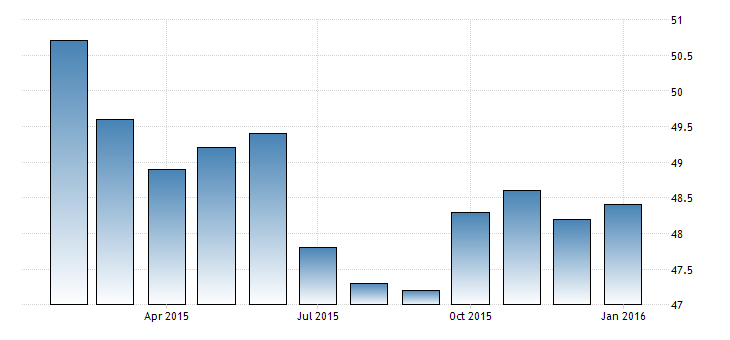

Once again, negative Chinese news started the week, with Markit reporting a 48.2 PMI. Production dropped; orders and prices were weak. The service sector expanded, with the PMI rising from 50.2 to 52.4. The composite index was a barely positive 50.1. Manufacturing is the biggest problem for a large number of markets. As the following chart shows, it’s been contracting for 11 consecutive months:

Markit also released Canada’s PMI.While it increased 1.8, it was still a contractionary 49.3. There were good points, however. Thanks to a weaker Loonie, exports rebounded. But due to weak oil prices, the Canadian manufacturing sector has been in a contraction for most of the last year:

Unemployment was unchanged at 7.7%:

The Bank of England kept rates at .5%.Their policy announcement contained two key paragraphs:

Returning inflation to the 2% target requires balancing the protracted drags from sterling’s past appreciation and low growth in world export prices against increases in domestic cost growth. Fully offsetting the drag on inflation from external factors over the short run would, in the MPC’s judgement, involve too rapid an acceleration in domestic costs, one that would risk being unsustainable and would lead to undesirable volatility in output and employment. Given these considerations, the MPC intends to set monetary policy to ensure that growth is sufficient to absorb remaining spare capacity in a manner that returns inflation to the target in around two years and keeps it there in the absence of further shocks.

In the first sentence, the Bank acknowledges the strong Sterling has done some of the banks work in containing prices. Next, they note the strong currency will, for now, keep inflation contained.In fact, should they raise rates in the current environment, the potential adverse effects will outweigh the benefits. This statement dovetails with Carney’s recent speech where we said in no uncertain terms that the BOE would not raise rates anytime soon.

Global growth has fallen back further over the past three months, as emerging economies have generally continued to slow and as the US economy has grown by less than expected. There have also been considerable falls in the prices of risky assets and another significant fall in oil prices. The latter appears largely to reflect news about the supply of oil. Developments in financial markets seem in part to reflect greater weight being placed on the risks to the global outlook stemming from China and other emerging economies. Looking ahead, growth in the United Kingdom’s main trading partners should continue to be supported by the boost to real incomes from low commodity prices, and to some degree by monetary and fiscal policy. But emerging market economies are likely to grow more slowly than in recent years and the risks to the MPC’s central projections of only modest global growth lie to the downside.

Leave A Comment