…Intelligent investors…understand that the long-term is the only time horizon that matters [and] one of the best ways to plan for the long-term is by setting reasonable expectations. What’s considered reasonable based on where we stand today? Hint: Lower your expectations for future stock market returns in the U.S., expect higher returns in foreign equities and brush up on your bond math.

Written by Ben Carlson (awealthofcommonsense.com)

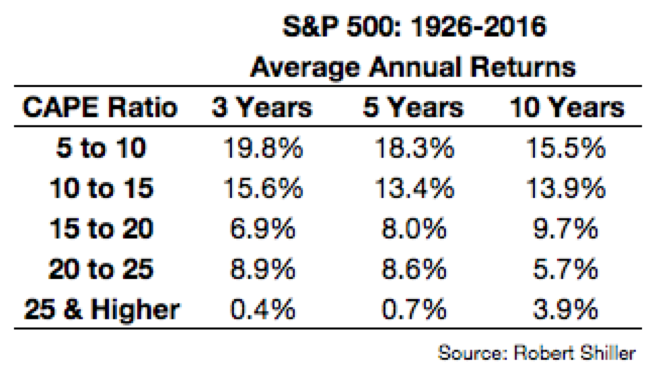

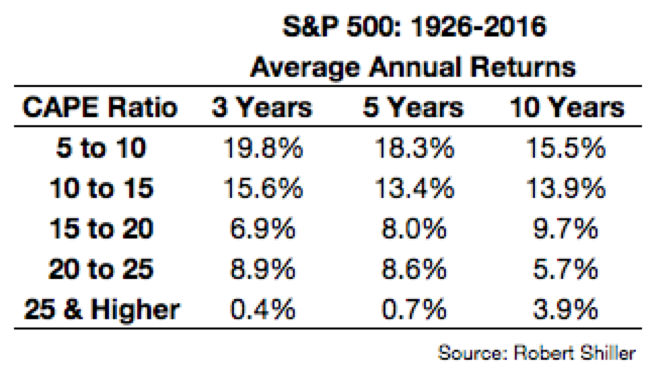

There is no easy way to predict stock market returns, but valuations are as good a starting point as any. Historically, the lower the starting cyclically adjusted price-to-earnings ratio, the higher the future returns have been on average, and vice versa.

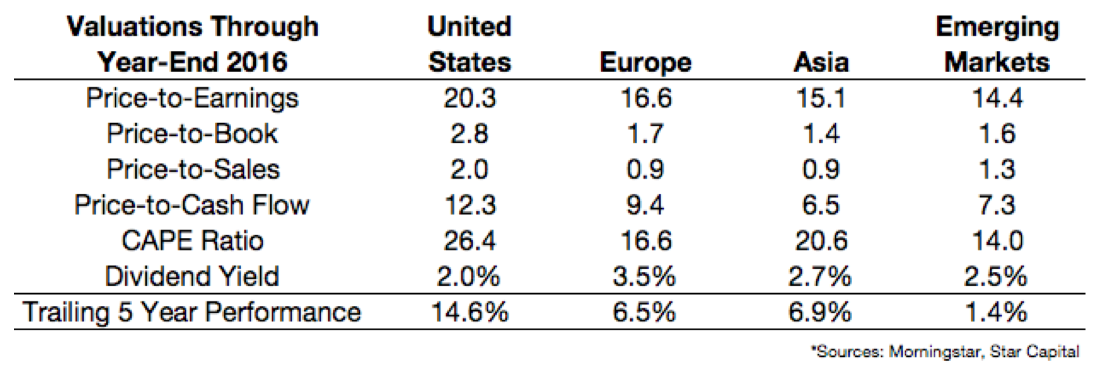

The CAPE ratio is by no means foolproof. It’s always good to look at a wider range of valuations to get a better sense of the current landscape to determine the markets that are more or less attractive around the globe. By those measures the rest of the world is trading at a discount of anywhere from 22% to more than 100% in terms of relative valuations in comparison to the U.S.

The U.S. is the most expensive market across every valuation metric, but that makes sense given the huge outperformance over the past five years. Taking the CAPE yield — the inverse of the CAPE ratio — would give us expected returns of 3.8 percent, 6.0 percent, 4.9 percent and 7.1 percent, going from left to right.

A crude formula for expected stock market performance, long championed by Vanguard Group Inc.’s founder, John Bogle, is:

The first part of the equation is simple and the second part can be approximated but the third part is a little tricky to pin down. Changes in valuations are driven by allocation preferences and investor sentiment. This is another way of saying that valuations depend on human emotions, which are almost impossible to predict.

Leave A Comment