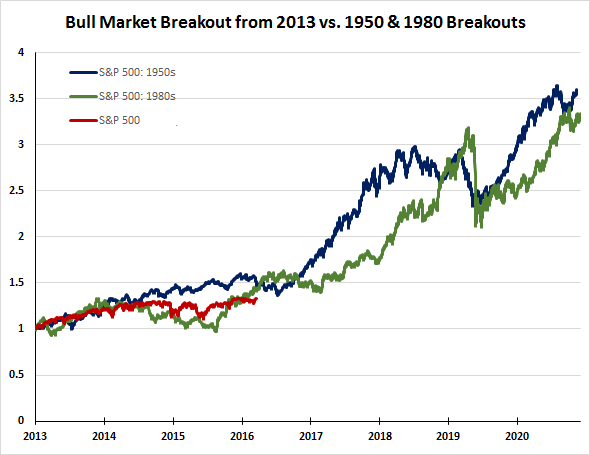

Subsequent to the election last month I published a post suggesting the equity market going forward was beginning to resemble the bull market of the 1950’s and 1980’s, A decade is a long time and market leadership will rotate in and out of sectors based on the business cycle. In that earlier post I noted the potential commonality to the current market compared to those prior decades related to policy decisions coming out of Washington, D.C.

In the 1950’s the Gross National Product in the U.S. more than doubled from 1945 to 1960. Government spending in the 1950’s was targeted at construction of the interstate highway system, building of schools and an increase in military spending. In the 1980’s President Reagan’s policies focused on reducing the tax burden on Americans, lowering government regulation and shrinking government itself. President Elect Donald Trump also projects to implement similar policies, i.e., reduce regulation, shrink the government, increase spending on infrastructure and lower taxes. For investors the question to answer is what market segments worked then and might these same sectors outperform early in a Trump administration.

The chart below shows the sector return for the period following the early 1980’s recession through 1989. For the entire time period, staples, health care and utilities outperformed with technology being the laggard. I include the Fed Funds target rate for reference since the current Fed is likely of the mind to continue its monetary tightening.

In the second half of the 1980’s the market continued its upward performance absent Black Monday in October of 1987.

So what worked in the first year following the 1982 recession? The leading sectors were technology, industrials and materials. The laggards were health care and utilities. In the first six months of the period, financials were the second best performing sector.

In 1984, utilities had strong returns in the back half of 1984 as the Fed’s target rate declined and making it the best sector performer in 1984. Staples and financials also outperformed while materials, technology and industrials lagged.

Leave A Comment