While everyone is listening to the noise of the Federal Reserve, we’re focusing on reality. Janet Yellen can wax intellectual about theories. We’ll continue to focus on the hard data, such as the 10-Year US Treasury Yield, an interest rate market participants should really care about.

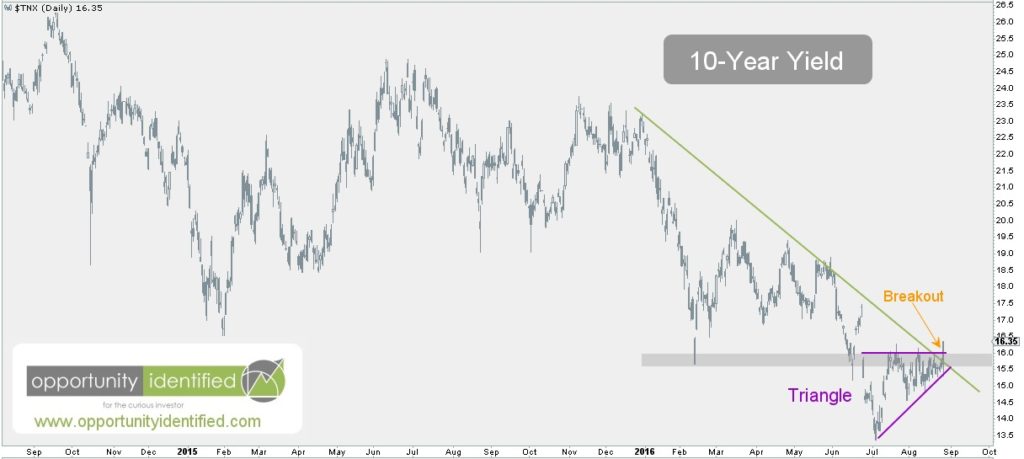

Since establishing an all-time-low in early July, the 10-Year Treasury Yield has found continuous support. So much so, that this important metric created a consolidation triangle near the lows established back in early 2015 and again in early 2016. You can see this important consolidation in the chart below.

With the 10-Year Yield breaking out, this could have some potentially positive consequences for equities. When we discuss bond yields, the supply and demand battle is fought on the bond price side of the product. As the 10-Year Treasury Bond price increases, its yield decreases. The opposite is also true. So the 10-Year Yield breakout highlighted above is a direct reflection of 10-Year Treasuries being sold. For many institutional investors, the 10-Year Treasury Bond is used as a safe haven. When the big money leaves a safe haven, what do you think it’s buying? You got it: Equities.

Nothing is guaranteed, but if the 10-Year Yield can sustain this breakout, it should provide a tailwind to Equities as an asset class.

Leave A Comment