Photo Credit: jessicalsmyers

Tiffany & Co. (TIF) Consumer Discretionary – Specialty Retail | Reports May 25, Before Market Opens

Diamonds may be a girl’s best friend but they haven’t been one for investors. In the past few years demand for jewelry has substantially declined, led by a strong U.S. dollar, weakness in China and changing spending habits. Consequently, jewelers like Tiffany have seen earnings fall for 4 consecutive quarters. The stock hasn’t been too far behind, down 25.6% over the same time frame. Unfortunately, investors should expect more of the same when Tiffany’s reports first quarter earnings this Wednesday.

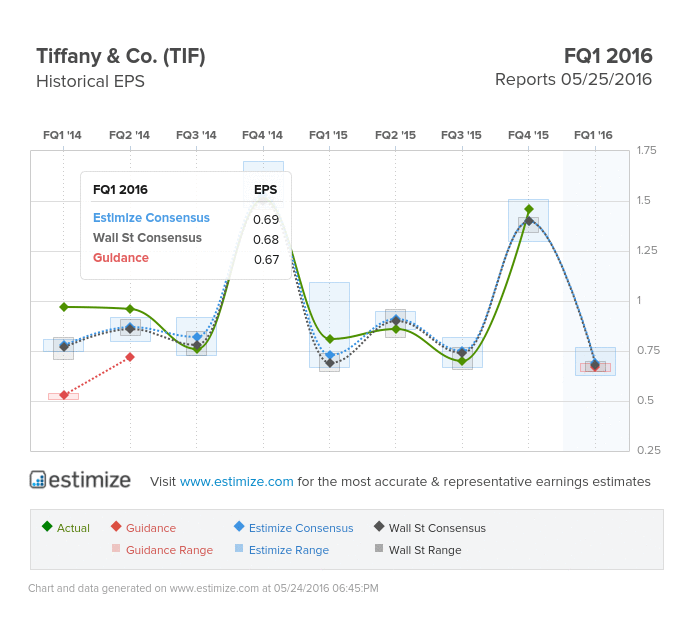

The Estimize consensus is calling for earnings of 69 cents per share on $922.64 million in revenue,1 cent higher than Wall Street on the bottom line but $2 million below on the top. Earnings per share estimates have dropped 13% in the past 3 months on negative sentiment towards quarterly earnings. Compared to a year earlier, this reflects a 14% decline in EPS with revenue projected to fall 4%.

Throughout 2015, Tiffany’s results were pressured by the strong U.S. dollar, macroeconomic volatility and changes in consumer spending habits. Currency headwinds negatively impacts both non-U.S. sales and tourist spending in the United States. Early indications are these problems will persist throughout fiscal 2016. In its most recent analyst call, management guided minimal growth on a constant currency basis with earnings ranging from unchanged to a mid-single digit decline.

On the other hand, there are a number of bright spots for Tiffany’s. The company’s efforts to bolster its omnichannel platform and open new stores should bode well. Meanwhile, on a constant currency basis, sales and comparable store sales increased across its international markets: Asia-Pacific, Japan and Europe. Taking currency headwinds into account, this turns negative across the board. For now, a dwindling top and bottom line remains a primary concern for the company and its investors.

Leave A Comment