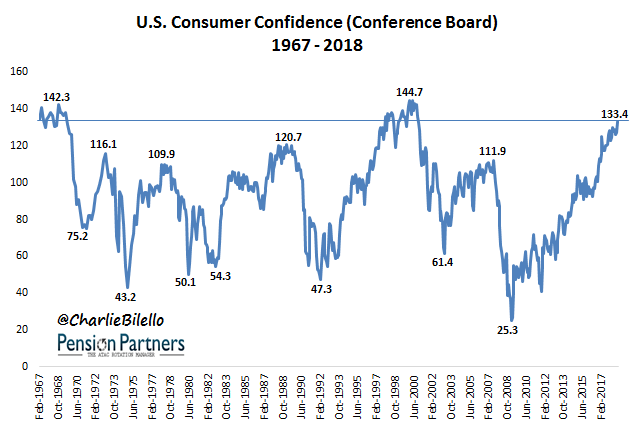

US Consumers are feeling pretty confident these days. A survey just released by the conference board showed the highest reading since October 2000. At a level of 133.4, consumers are more confident today than 94% of historical readings going back to 1967.

Data Source for all charts/tables herein: Conference Board, Bloomberg

If you asked the average person on the street, they’d likely say that’s good news for the stock market.

Their line of thinking would go as follows: a more confident consumer –> more consumer spending –> stronger economy –> stronger stock market.

This seems rather intuitive but does the data support such a thesis? Let’s take a look…

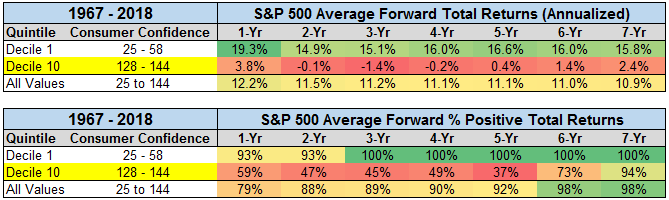

If we separate the Consumer Confidence readings into deciles and compare the higher and lowest deciles, we find the following:

How is that possible? Why would there be a negative correlation between Consumer Confidence and future stock market returns?

Well, when there’s good news in the economy (high consumer confidence), investors are willing to pay a higher multiple for a given level of earnings than when there’s bad news (lower consumer confidence). That’s important when it comes to stocks because higher valuations tend to be associated with below average forward returns.

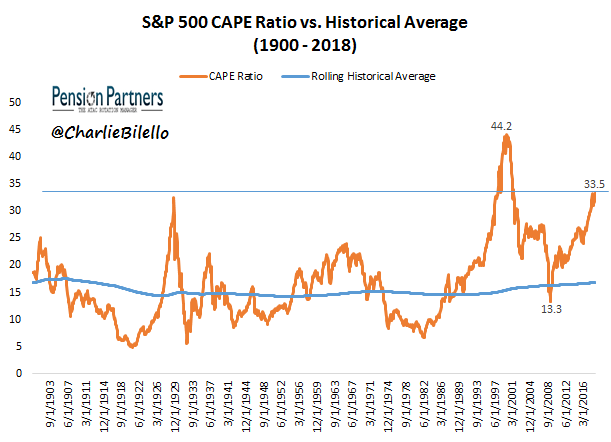

When Consumer Confidence hit a record low of 25.3 in February 2009, the CAPE Ratio (P/E ratio using an average of 10 years of earnings, adjusted for inflation) on the S&P 500 stood at 14.1. Today it stands at 33.5, its highest level since 2001.

Does that mean the S&P 500 has to deliver below-average returns from here? No, these are just probabilities and tendencies; there are always exceptions. In early 1998 the S&P 500 was as richly valued as it is today and stocks continued to march sharply higher for 2 more years before ultimately peaking in March 2000.

Leave A Comment