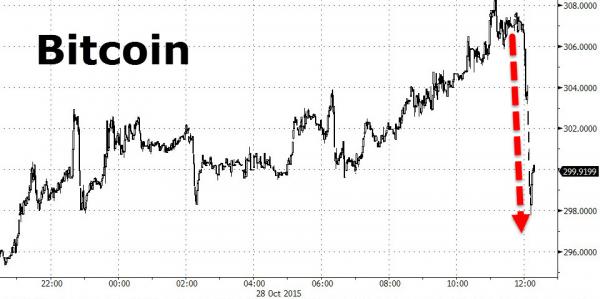

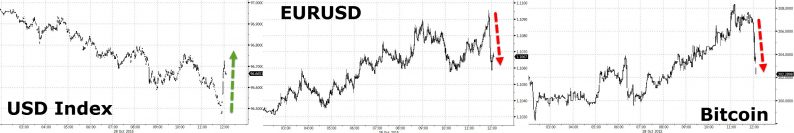

Across the entire ‘currency’ complex a sudden USDollar buying scramble into the London Close fix has sparked weakness across everything from Swiss Francs to Bitcoin…

Click on image to enlarge

What are the fixes?

There are loads of different types of fixes, but the main ones are at 11 a.m. and 4 p.m. London time.

That’s not the only thing fixes are used for. Some asset managers, for example, use them purely to mark their foreign-currency-denominated holdings to market. It’s just a reference point. But some trade on them.

To trade on them, effectively you tell your bank in advance of the relevant time that you would like to buy X amount of euros at, say, the 4 p.m. fix.

As WSJ notes, everyone in this market knows there’s often a little extra volatility in exchange rates around fix times. But that’s largely because traders have to hedge themselves in advance of flows, and because while fix-based flows account for only 1-2% of the overall market, they are shoved through a very small trading window of one minute. they all take place in a one-minute trading window.It’s like everyone trying to squeeze through a doorway at the same time.

One senior banker explains as follows:

“[The trader] has to know this in advance—he has to hedge himself somehow as he has a large amount to buy, and by 4:00 p.m., he has to match the rest of the street.”

Matching the street? See, you will then get the mid price (NB: not the bid or the offer price—the middle point) of which ever rates were traded by a range of banks during the one-minute period around fix o’clock.

We presume the FX chatrooms were busy this morning (as they were all about currency manipulation at the fix)

Ironically, it appears Bitcoin is suffering the most for now…

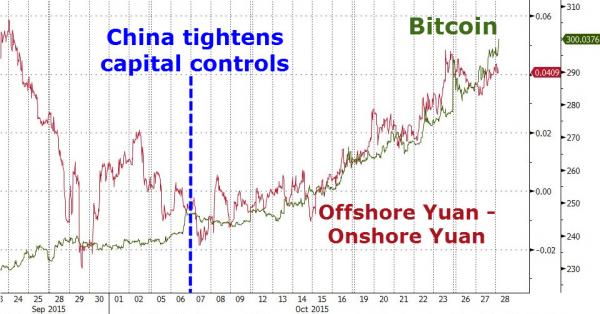

Perhaps someone did not like the implications China outflows we hinted at…

Charts: Bloomberg

Leave A Comment