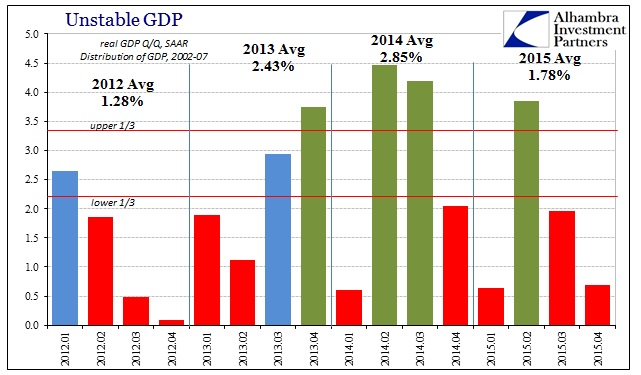

Fourth quarter GDP was estimate at just +0.68906% Q/Q in its advance statement. There is no more “residual seasonality” left with which to obfuscate the deficiency in 2015; the year ended as it had begun, under great suspicion. Unlike most economic context given as commentary, that actually makes sense as both markets and other more fruitful economic measures have been suggesting all along. At best, GDP has exhibited great instability which is itself an indication of weakness since GDP was constructed to be the most charitable interpretation of economic growth.

Instead of riding into the sunset of QE-inspired success, the economy last year decelerated and left only questions as to exactly that. The year saw only one quarter that could be in any way characterized as decent, leaving three as undesirable; two unconscionably close to zero.

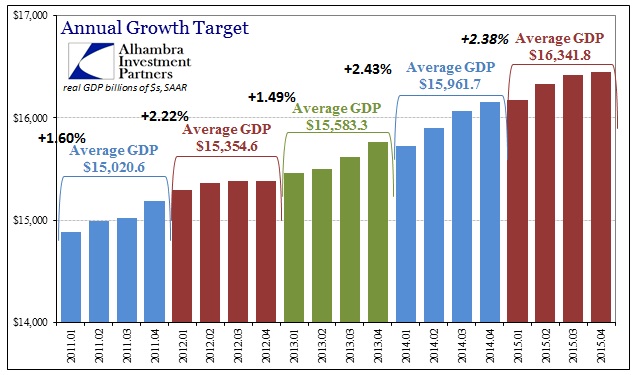

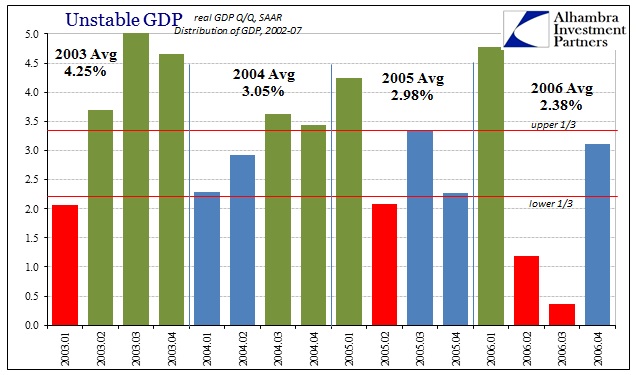

By the standard of average SAAR’s, GDP in 2015 was +2.38%, slightly less than 2014’s 2.43%. In terms of average Q/Q, 2015 was appreciably worse at just 1.78%; not really meaningfully better than even 2012 and certainly nowhere near projecting “overheating.” In fact, by comparison to the last “recovery” after the dot-com recession, 2015 seriously underperforms 2006 (a year that included half of it on the wrong side of the housing bubble).

That left the FOMC little choice but to make the alteration to its statement language in January, being forced into acknowledgement that GDP was no longer confirming their view. That leaves the FOMC’s recovery as purely the imagination of the BLS and its hopelessly isolated unemployment rate. The GDP report provided only contradiction for the “inflation” reality in 2015, too. If the Fed meant that calculated inflation rates would at least begin to respond to past monetary policy efforts bearing fruit in the actual economy, then the fact that nominal GDP failed to reach the 2% threshold twice in 2015 has to be a fatal blow to any designs about “slack” being sufficiently addressed. Again: Nominal GDP failed to reach 2% half of the year, including the last three months.

Leave A Comment