Photo Credit: Mike Mozart

Lowe’s Companies Inc. (LOW) Consumer Discretionary – Specialty Retail | Reports May 18, Before Market Opens

Key Takeaways

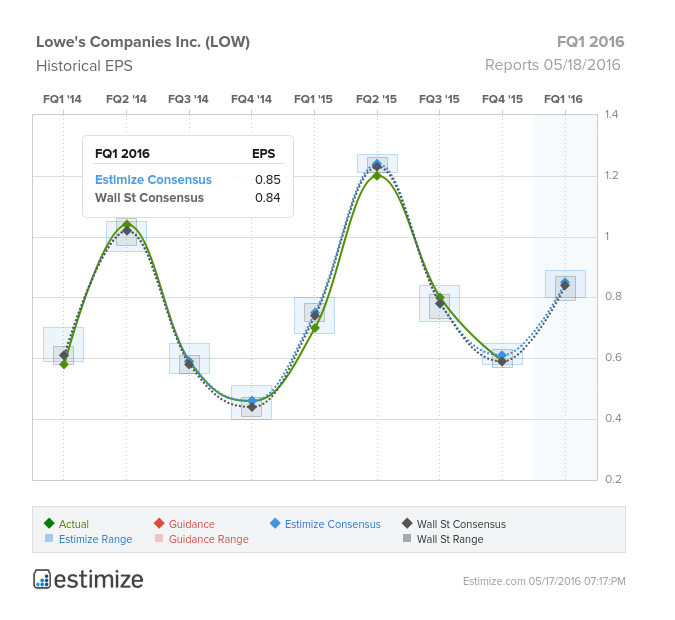

Home improvement retailer, Lowe’s, is scheduled to report first quarter earnings Wednesday, before the market opens. Earnings of late have been right in line with expectations and this quarter should be no different. The Estimize consensus is looking for earnings of 85 cents per share on $14.84 billion, 1 cent higher than Wall Street on the bottom line and $20 million on the top. Compared to a year earlier, this projects as a 21% increase in earnings with sales expected to grow by 5%. On average the stock is a positive mover during earnings season. In the 30 days prior to a report, shares typically increase 3% and continue to increase until the 30 days following its report. Shares are now up 17.4% in the past 3 months.

Improving employment numbers coupled with the housing market recovery has panned out favorably for Lowe’s. Last quarter delivered a 5.2% increase in comparable store sales with positive gains across all product categories. Meanwhile, the home retailer is making sound progress in its international expansion. The company’s Canadian business continues to post strong comp growth and recently took over 12 former Target locations across the country. Additionally, Lowe’s recently acquired Canadian based home and garden company, RONA, to help further its position in Canada. Lowe’s is benefiting from its strategic acquisitions, all of which present a significant opportunity in the home improvement space. That said, Lowe’s still plays second fiddle to Home Depot (HD) which posses a majority of the market share in this space.

Leave A Comment