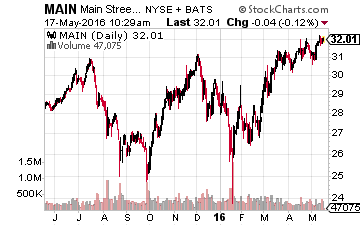

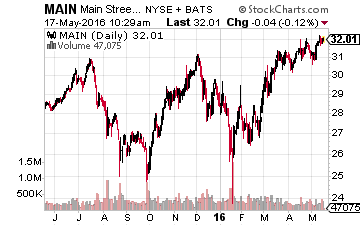

Over the past six weeks, I have made presentations at several investor conferences. One of the benefits I receive at these conferences comes from watching the presentations of other invited experts and learning from them. One such presentation that I learned a great deal from was a candid talk by Main Street Capital Corporation (NYSE: MAIN) CEO Vince Foster. It completely changed my outlook for one type of high-yield stock.

Main Street Capital is a business development company (BDC). There are about 40 publicly traded BDCs and almost all sport high dividend yields. The primary business of a BDC is to lend money to small and mid-sized corporations. The sector operates under special business and tax rules that limit how much leverage a BDC can carry in relation to its equity, and a BDC that follows the rules does not have to pay corporate income taxes. This is a pass-through business structure, similar to real estate investment trusts (REITs). The pass-through business structure requires a BDC to pay 90% to 95% of its net investment income as dividends to shareholders. Besides loans, a BDC can also make equity investments in its client companies. Equity investments can be ownership stakes or warrants that pay off if a client company gets bought out or goes to market with an IPO.

I learned a big lesson from Foster’s presentation: BDC’s make high-yield, high-risk loans to companies that cannot get traditional bank financing. The high-yield side allows a BDC to pay big dividends to share owners. The high-risk side means there will inevitably be some loans that do not get fully paid off. If I remember correctly, Foster gave a 4% number of the total loan portfolio balance that a BDC will lose on an average annual basis.

Now we get to the big problem with the BDC business structure. Unlike regular commercial banks, the BDC rules do not allow these companies to reserve against loan losses. Loan losses lead directly to a reduction of a BDC’s equity and their book or net asset value per share. Also, since the company must pay up to 95% of net interest income out as dividends, the interest earned on a portfolio cannot be reinvested in the business to offset loan losses.

Leave A Comment