Photo Credit: Mike Mozart

SodaStream International Inc. (SODA) Consumer Discretionary – Household Durables | Reports May 10, Before Market Opens

SodaStream’s massive efforts to reposition its brands have begun to show encouraging signs. Last quarter SodaStream reported early progress with a beat on both the top and bottom line with year over year comparisons starting to improve. It has been almost a full quarter since the company has transitioned away from sugary soda to healthier sparkling water alternative. For the first quarter, SodaStream is expected to see improving sales trends as its initiatives gain continue to gain traction.

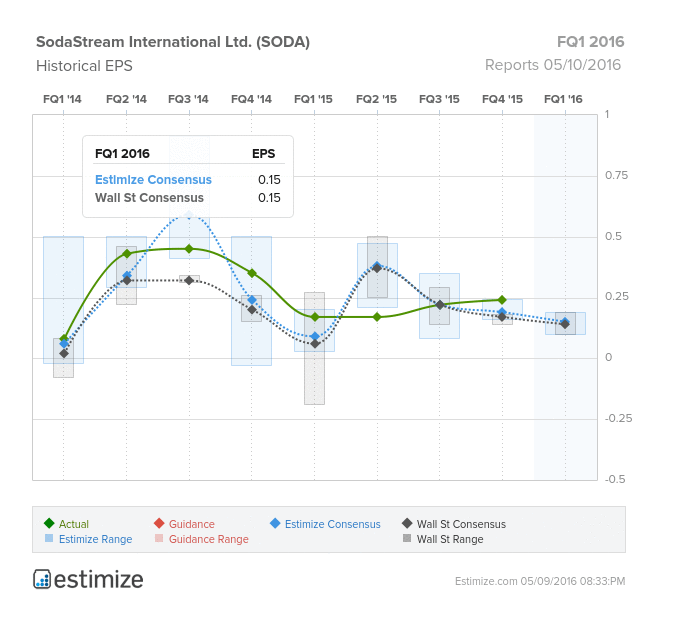

The Estimize consensus is calling for earnings of 15 cents per share, down 13% in the past 3 months, on $89 million in revenue, right in line with Wall Street on both the top and bottom line. Compared to a year earlier profits are predicted to decline 16% with sales falling as much as 2%. This is a huge improvement from last quarter which saw earnings decline 31% and revenue decline 11%. SodaStream’s recent underperformance however has weighed heavily on the stock which is down 31% in the past 12 months. Fortunately for SodaStream, share prices are relatively unchanged leading up, through, and following its earnings report.

SodaStream has historically positioned itself as a soda maker but with shrinking consumptions trends the company has begun to run new promos to get people to drink more water. By introducing its machine as a sparkling water manufacturer and offering new syrups, SodaStream can eliminate the stigma of unhealthiness that may have hurt sales in the past. Apart of the transformation, Sodastream rolled out a new sparkling water maker, Power, during the second half of last year. The company has begun to see some of its efforts gain traction. In Europe, its largest market, started to turn positive.

That said, SodaStream’s turnaround is unlikely to reach its highs of a few years ago. The company’s improved sales trends are likely to be dampened by weak currency conditions. Advertising costs are also expected to climb as the company works on new promotions to drive demand.

Leave A Comment