The strategy of favoring low-priced stocks over their high-price counterparts has been floundering in recent years, inspiring some investors to give up on the value tilt for money management. But a recent run of reporting suggests that a new dawn may be at hand for this corner of investing.

A Barron’s cover story on April 28 asks: “Are Value Stocks Ready to Grow Again?” Meanwhile, CNBC recently reported that Chad Morganlander, portfolio manager with Washington Crossing Advisors, has started overweighting value stocks over growth stocks.

It’s anyone’s guess if value investing is primed to run hot again relative growth. Similar predictions in recent years have come to naught so far. Is this time different?

Hold that thought as we review how the value-growth race stacks up at moment in large- and small-cap stocks, based on representative ETFs. As a preview, the basis for a revival in the historical edge appears firmer in small-cap shares. Value investing via large caps, by contrast, still looks set to trail growth for the near term.

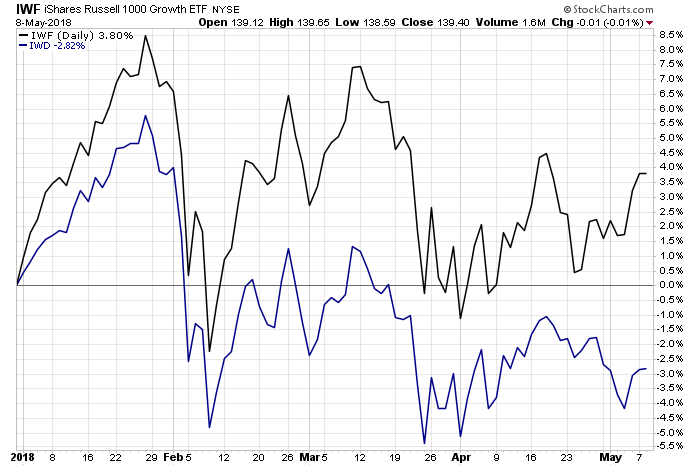

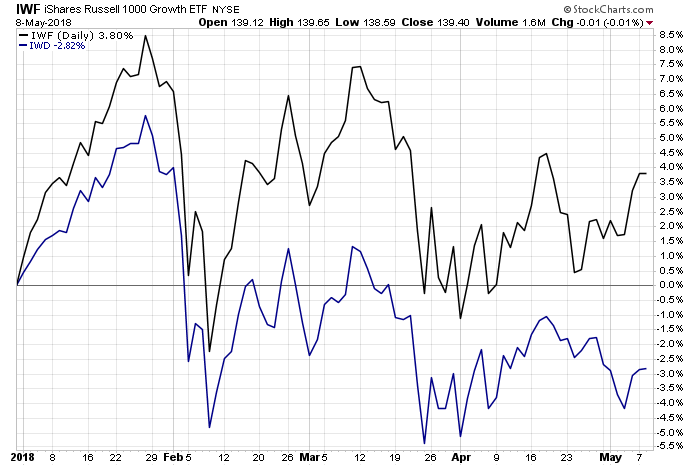

Let’s begin with large caps. So far this year, through yesterday’s close (May 8), large-cap growth’s hefty lead shows no sign of withering. The iShares Russell 1000 Growth ETF (IWF) is up 3.8% year to date (black line), a sizable premium over the 2.8% loss for iShares Russell 1000 Value (IWD).

A change in leadership doesn’t appear imminent, based on a momentum profile via moving averages. Consider, for example, that while the IWF closed modestly above its 50-day average yesterday, the large-cap value IWD is trading below that mark. In addition, IWD’s 50-day average has been trending down recently and appears close to falling below the 200-day average. If and when that break arrives, the near-term outlook for large-cap value shares will deteriorate further.

Looking at value through a small-cap lens offers a more encouraging profile for the year-to-date results. Although small-cap growth is beating its value counterpart so far in 2018, both facets are reporting positive gains at the moment.

Leave A Comment