In the old days, when a stock or a market index broke out of a trading range accompanied by some “oomph,” it was good thing. In fact, such an event was considered to be a strong signal that the move would continue and that it was time to jump on board the bull train. “Buy high, sell higher” was the momentum trader’s battle cry.

However, times were simpler then. The “fast money” types weren’t on television all day, every day, teaching anyone willing to listen how to “fade” every rally. Computers didn’t run the game. Volume was “real” and trades weren’t measured in nanoseconds. No, when a significant breakout occurred on the charts, it meant that folks were buying in a big way. Thus, it generally paid to follow the crowd.

In my paper entitled, The Tactical Dilemma I detail how and why such an approach has become less effective in recent years. I provide examples of traditional trend- and momentum-oriented indicators that after working well for literally decades, have stopped working altogether since the credit crisis ended.

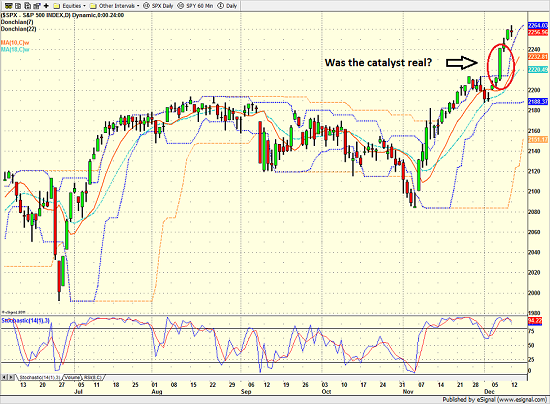

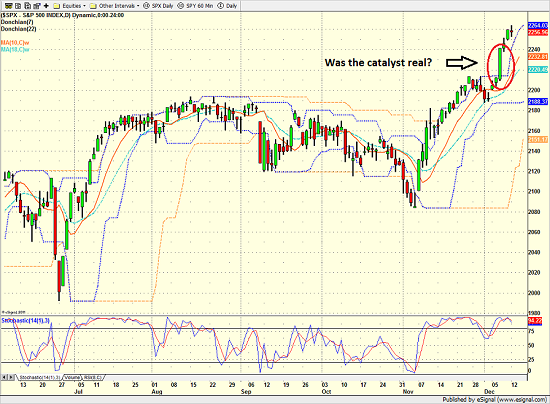

Why do I bring this up on this fine Tuesday morning? In short, because it appears that we are witnessing a classic momentum breakout. A move that began last Wednesday and was accompanied by very strong volume. And a move that is now experiencing what is called “follow through.”

For those that haven’t been around the game for a couple decades, this combination used to be a very good sign. However, today the question that has to be asked is: Was the move real or just another example of high-speed trading gone haywire?

I know that most everyone agrees that the “Trump Trade” is the driving force right now in the markets. And given the state of the calendar, it isn’t surprising to see investors of all shapes and sizes clamoring to get on the bull train. After all, everybody knows that the best time of year to be in stocks is between November and April. And with expectations running high that the Trump administration will create a strong macro backdrop for stocks, it makes sense that now is the time to be buying – perhaps even with both hands, right?

Leave A Comment