While no chart could have possibly predicted the populist outcry against Martin Skreli’s widely publicized, and panned, decision to crassly boost the price of a Toxoplasmosis drug by over 5000% (doing something all other biotech companies have been doing but with all the grace of a bull in a china shop thus prematurely ending the party for everyone) only to promptly undo his decision following a furious public backlash which also resulted in Hillary Clinton proposing a price cap on specialty drugs and unleashing the worst drop for biotech stocks in 2015, now that concerns about a biotech top are in play, the biotech sector just can’t seem to catch a bid.

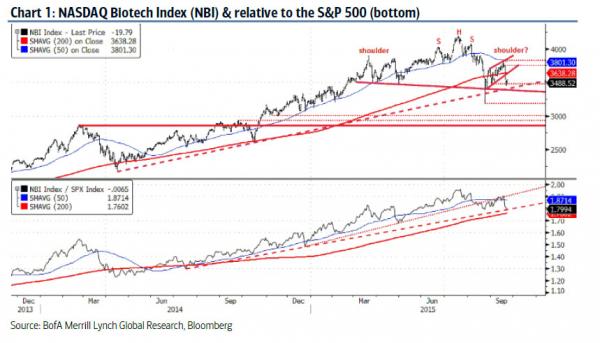

One reason for the continued weakness may be that, as Bank of America points out, there are signs the dreaded head and shoulders top has appeared in the Nasdaq Biotech Index.

While on its own this would be completely irrelevant, as fundamentally-driven investors would be quick to object, the fact that it is none other than technicians and chartists who have been instrumental in pushing biotech stocks to their recent nosebleed levels, it will be the same “chartists” who will be scrambling at any bearish signals on the way down (furthermore, for the biotech sector where for 90% of the companies it is all hype and technicals, there is no “fundamentals” to speak of).

Such as this one.

More from BofA’s Stephen Suttmeier:

Biotech struggles & shows signs of a head & shoulders top

The NASDAQ Biotech Index (NBI) shows signs of a distribution top with the risk for a deeper pullback. Unlike pullbacks in 2014, the August/September 2015 drops have struggled to hold the 200-day moving average (MA). The rally from late August looks corrective and has stalled with the 200-day and 50-day MAs at 3638-3801 starting to act as resistance. We cannot rule out a head and shoulders top and pushing below 3410-3380 would break the neckline and uptrend line from 2014 to confirm this pattern. This would suggest deeper risk to 3181 (August low) and then 3000-2860. It would take a break above 3828-3902 to completely negate the risk of a head and shoulders top.

NBI is weakening vs. the S&P 500 & leadership at risk

The NBI is weakening relative to the S&P 500 and is a market leadership group at risk. The group could experience a deeper correction within a long-term relative uptrend.

Leave A Comment