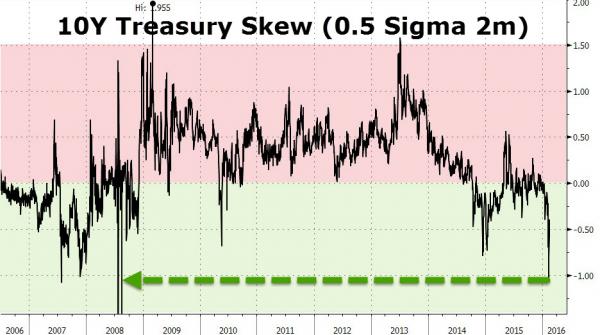

Amid last Thursday’s cataclysmically illiquid flash-crash like collapse in Treasury yields, speculators in extreme net short positions reached for anything to hedge their positions. Most remarkably, call-buying (i.e. betting on / hedging lower yields) relative to put-buying exploded to a record skew. It would appear that the utter panic protection positioning is being unwound in the last few days and that has dragged yields considerably higher. Today the skew is back to “normal” and Treasury yields are once again falling, unfettered by the technical flow from panicced options hedges.

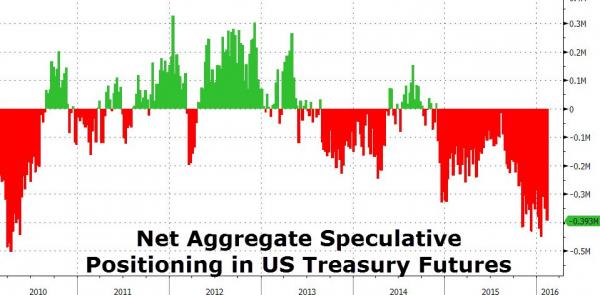

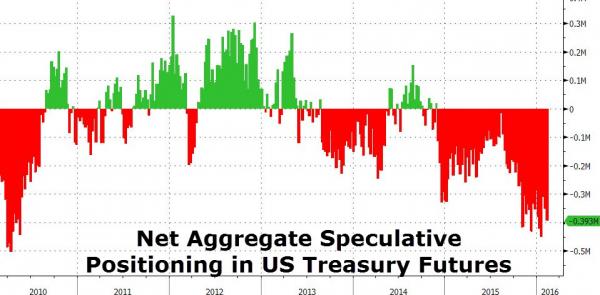

Aggregate (10Y equivalents) speculative positioning in Treasury futures was already near record shorts…

And so last week’s yield crash sent the Treasury skew crashing to record lows… (positioning/hedging for lower yields)

Those apparently panicked hedges have been quickly lifted as rumors, news, central banker promises, and flows have calmed the chaotic moves – dragging the skew back to “normal” and smashing yields higher…

And now that the skew has normalized, yields are falling once again as the deflationary wave pressures continue…

Charts: Bloomberg

Leave A Comment