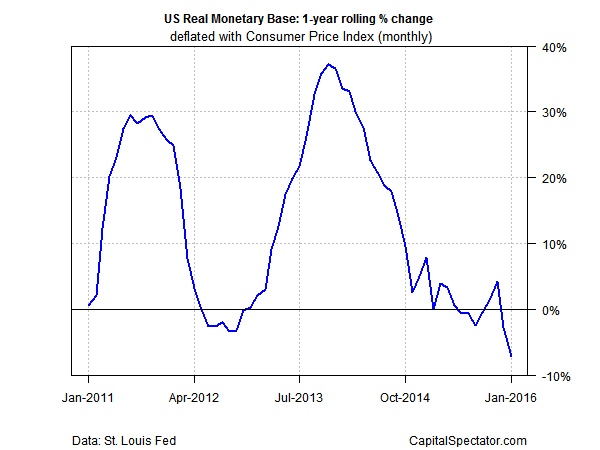

US monetary liquidity in January contracted at the sharpest rate in decades, according to the real (inflation-adjusted) year-over-year trend in base money (M0). It’s debatable if this alone is a warning sign for the macro outlook, but it’s an indicator that just went ballistic.

It’s always dangerous to reason from one set of numbers—even a crucial one like monetary policy. But neither is it wise to ignore a critical indicator when it goes to extremes. That certainly characterizes M0’s annual change through January. Indeed, real base money (the St. Louis Adjusted Monetary Base deflated by the consumer price index) contracted by 7.2% last month vs. the year-earlier level—the lowest since 1948!

The good news is that last month’s economic profile for the US looks encouraging. Yesterday’s update of three-month average of the Chicago Fed’s National Activity Index rose to a four-month high in the kick-off to 2016. Although the macro trend continues to roll along at a pace that’s below the historical trend, the odds are low that a new recession started in January, according this benchmark. That offers some comfort for thinking that the moderately positive bias will spill over into months ahead. But there are still reasons to be cautious, and you can add monetary policy by way of base money to the list.

It’s no surprise to see that the rare instances of negative changes in real M0 tend to coincide with recessions. Will it be different this time? Perhaps. After all, ours is a period in time when everything related to macro seems to be different. History, however, is relatively clear. (Note: the chart below ends in 2007 for easier historical viewing due to dramatic changes in M0 after 2008, which sharply expands the y-axis scale.)

Let’s recognize that there are other aspects of monetary policy trending positive—the Treasury yield curve in particular is still upwardly sloped, which implies that the near-term outlook still favors growth. Meanwhile, the current US GDP projection for the first quarter is solidly positive, based on the Atlanta’s Fed’s recent nowcast (as of Feb. 17). In addition, the Philly Fed’s ADS Index (based on data through Feb. 13) continues to point to a robust expansion for the foreseeable future.

Leave A Comment