Has Wells Fargo gone from being “the best thing since sliced bread” to “toast”?

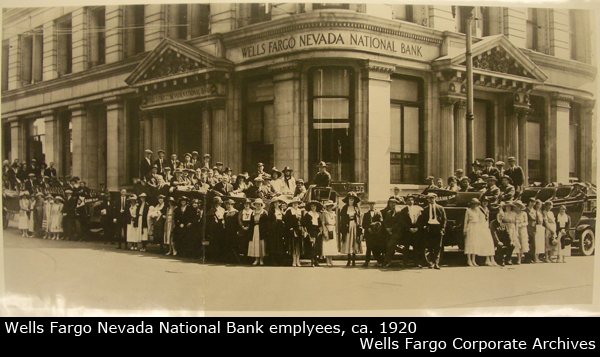

Wells Fargo (WFC) did some incredibly stupid things that came to light last fall. A bank that was a key contributor to the opening of the West and a proponent of fair business practices, and the least-fined major bank coming out of the banking fiasco of the recent recession, screwed up.

Under its now-fired Chairman and CEO John Stumpf and his over-zealous protégé Carrie Tolstedt, WFC employees were encouraged to open and rewarded for creating 2 million phony bank accounts. Wells has been fined $185 million — so far — for these transgressions. They have however “clawed back” incentive pay and bonuses – so far — of $69 million from Stumpf and $63 million from Tolstedt. Leaving aside the question of why WFC believes it had to pay so much money for individuals fomenting such malfeasance that $132 million is considered only a partial pay-back, they are at least mitigating some of those fines.

More importantly, Wells still has a retail franchise with more branches than any other US bank. This is quite the competitive advantage. As commercial and individual customers seek to borrow before future rate rises, WFC has deep pockets well-replenished by its many depositors nationwide. Barring another Great Recession, I believe interest rates will increase steadily in the next 1-2 years which in turn will increase Wells Fargo’s margins.

In addition, as the nation’s largest mortgage originator, Wells will benefit as more Millennials seek to buy homes and more individuals become re-employed. (See article here on the likely real estate recovery.)

This is the third-largest bank in the country and the one which, until recently, employed the sharpest executives and managers. I believe that this recent scandal was a one-off and the bank is now committed to restoring its customers’ faith and moving forward with the strengths its size and geographic reach provide. This, too, shall pass.

Leave A Comment