Peak Economic & Earnings Growth?

The debate among investors is whether growth has peaked. I think economic growth peaked in 2017. The blue chip average is at 3.1% growth for Q2, so that’s not settled yet. The main problem with the 2018 economy is expectations were so high headed into it. If 2018 growth is slightly less than 2017, it would be a big disappointment from the initial expectations. The ECRI model projects economic growth will pick up in the next few months before falling again. That may be the final decent towards a recession. It will be interesting if stocks start to rally on positive reports in the next few months or if the worry about rate hikes prevents a rally.

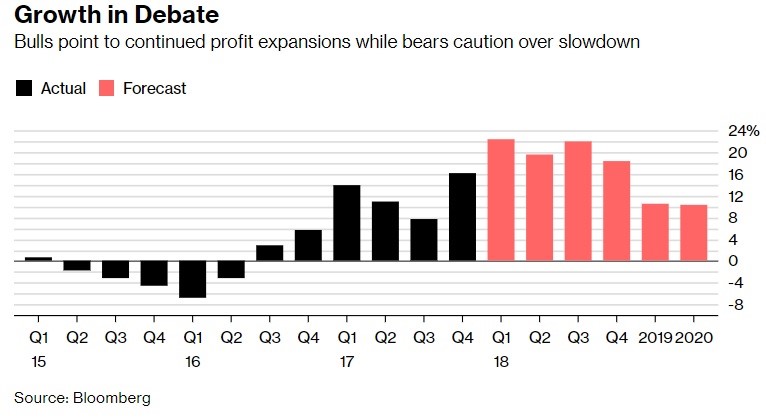

Earnings growth probably hasn’t peaked yet. The chart below shows Q1 earnings grew 22.4%. It gives the appearance that growth in Q2 and Q3 will be lower than the current period, but that’s wrong. The earnings growth was expected to be 17.1% headed into this quarter. If the beat rate is similar, you can say any expectation above 17.1% growth shows acceleration. Growth is expected to be 19.6% in Q2, 21.9% in Q3, and 18.4% in Q4. All those quarters could have higher growth if the expectations don’t fall before the reporting period and the results beat estimates at a decent rate. The peak growth rate should be in Q2 or Q3; the real drop off will occur in Q1 2019. This is a topic I’ve discussed for a few months. I didn’t expect the market to ignore the current great earnings reports for the decelerating results in 2019 until later in this year.

Peak Growth Only Bad At The End Of The Cycle

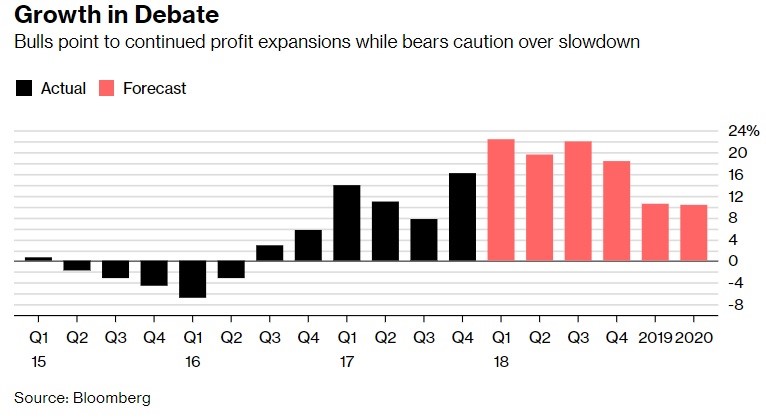

The interesting part about this period is earnings growth peaks aren’t usually a problem. As you can see from the chart below, the average return in the next 12 months following an earnings peak is 8.9%. The problem with this earnings period is it is probably more like the 1999 and 2006 peak than the others listed because we are late in the cycle. Investors aren’t worried about earnings growth in 2019 being in the high single digits or low double digits. They’re worried about a recession eliminating all growth. That’s far from a certainty, but it has enough likelihood to limit share price gains.

Leave A Comment