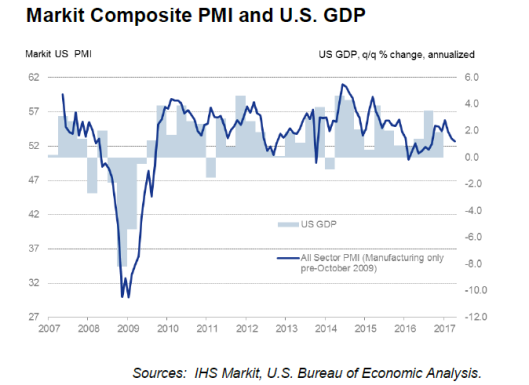

Unlike their counterparts at the ISM, Markit sees growth in both services and manufacturing weakening with U.S. private sector growth at a seven-month low in April.

Markit notes that a profit squeeze on businesses. Input prices are rising faster than final prices on goods and services.

Markit’s chief economist keeps his 1st quarter GDP estimate at 1.7% but estimates the 2nd quarter will get off to a rocky start at 1.1%.

Key Findings

At 52.7 in April, down from 53.0 in March, the seasonally adjusted Markit Flash U.S. Composite PMI Output Index signaled a further slowdown in private sector output growth. The latest reading pointed to the weakest rate of expansion since September 2016.

April data also revealed the weakest rise in private sector payroll numbers since February 2010, driven by a softer pace of staff hiring among service providers.

There were signs of a squeeze on operating margins in April, as input price inflation reached its strongest since June 2015. At the same time, prices charged by U.S. private sector firms increased only marginally and at the slowest pace since November 2016.

April data signaled a sharp and accelerated rise in average cost burdens across the manufacturing sector. The rate of input cost inflation was the fastest since December 2013, which survey respondents linked to rising commodity prices (particularly metals). Meanwhile, pressure on

margins from higher input costs contributed to the strongest increase in factory gate charges for almost two-and-a-half years.

Comments by Chris Williamson, Markit Chief Economist

slowing further from the two-year high seen at the start of the year, despite export orders lifting higher.”

Leave A Comment