The 200 day moving average for the S&P 500 Index (SPX) is all anyone really cares about right now. Once 2000 on SPX was broken to the upside the 200 dma near 2025 became the next major resistance level. The vast majority of tweets are targeting that area. When everyone is watching the same overhead level it becomes natural resistance so we should expect a pause this next week if the market pushes higher.

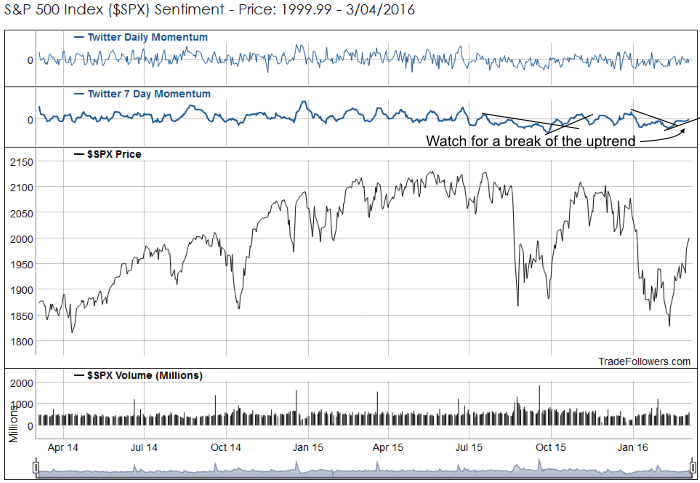

Momentum and sentiment from Twitter for SPX is stalling as a result of the large number of tweets mentioning overhead resistance. However, the move in the market was enough to create a new confirming uptrend in 7 day momentum. Watch for a break of that trend line for a sign we’re resuming the longer term down trend.

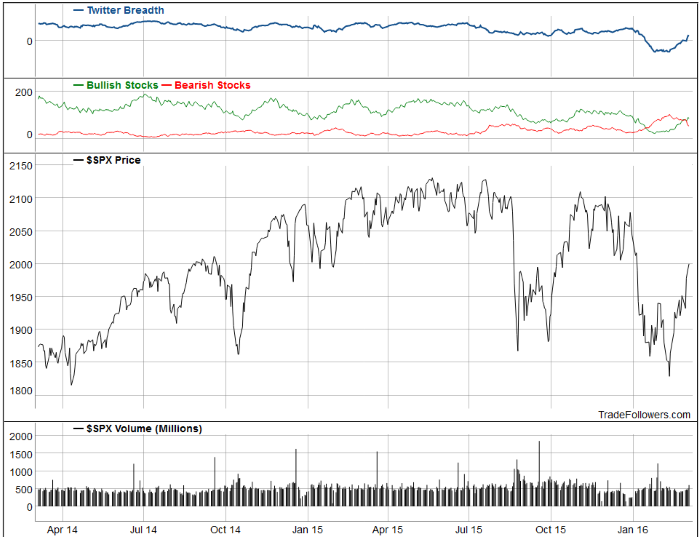

Breadth between bullish and bearish stocks is rising sharply as the bearish count falls and the bullish count rises. Breath printed +22 on Friday. As I mentioned last week, I think the indicator has a bullish bias, so a level above zero (maybe +20 to +25) might be where bear market rallies peak. We’ll need to watch and see how it performs if the market turns back down. The level where breadth peaks will give us a reference point for future bear market rallies.

Sector sentiment was mostly positive last week.

Conclusion

About the only thing to watch this coming week is how the market, breadth, and momentum react to the 200 day moving average on SPX. You can watch daily breadth from Twitter here, and Twitter momentum and sentiment for SPX here. Bulls want to see 7 day momentum hold its trend line. A failure would likely indicate a resumption of the down trend.

As a side note, the Downside Hedge Market Risk Indicator cleared its warning last Friday. This doesn’t mean the bear market is over. On the contrary, look at the chart below and you’ll see many times where the indicator cleared just before the market resumed its downtrend. It is designed to warn when there is significant risk of a waterfall type decline. It has a good track record of warning before large declines, but whipsaws often as a market top is being built. The current picture is looking a lot like late 2007 and early 2008.

Leave A Comment