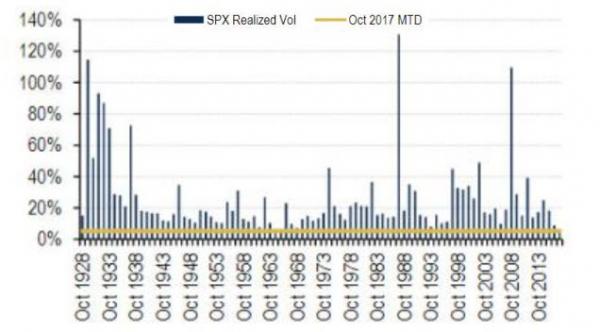

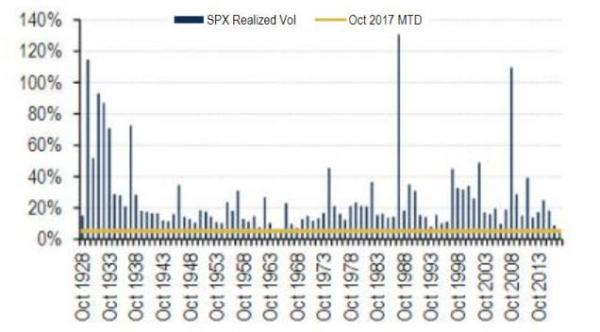

October is historically the most volatile month of the year, but in 2017 – the average volatility of US equity markets dropped to an all-time record low…

… And you know something’s wrong when, just like in early 2007 when the crash in vol killed the swaptions industry – just before all hell broke loose – Goldman Sachs is pulling back from U.S. options market-making on exchanges.

The Wall Street Journal reports an extraordinary calm in markets has choked the trades that typically funnel through banks’ derivatives desks.

Waning stock volatility is pressuring the equity derivatives business, suppressing revenue and driving traders out of what was once a key Wall Street moneymaker.

Goldman Sachs pulled back from U.S. options market-making on exchanges, a spokeswoman for the firm said Thursday.

It’s the latest to withdraw from the business of continuously buying and selling contracts on venues using automated programs.

Revenue in an equity derivatives business that focuses on listed options shrank by 41% in the U.S. and by 28% globally during the first half of 2017 from the same period a year ago, according to data firm Coalition, which tracked 12 of the biggest banks in the world.

The number of employees in equity derivatives at banks has contracted by about 10% since 2012, Coalition data also show.

“With lower volatility this year, we’re seeing less of those trades come through,” said Coalition’s research director Amrit Shahani.

“It’s a vicious cycle.”

OptionMetrics LLC founder David Hait said investors tend to think of options as insurance for stock bets.

With U.S. equities in an eight-year bull market, people are asking, “What do I need an option for?” he said.

After 16 years of trading options during which he ascended to managing director at Bank of America and Deutsche Bank, Zahid Biviji left Wall Street this year, citing fewer opportunities in the space, partly caused by regulations imposed after the financial crisis.

Leave A Comment