Technical analyst Jack Chan has examined the charts and says the gold sector is on a new major buy signal, which could signal a new bull market, but he is patiently waiting for confirmation.

The gold sector is on a new major buy signal, therefore opening the opportunity of a new bull market. However, Commitment of Traders (COT) data remains in bear market values and is now at levels of previous tops. I remain patient and wait for confirmation, which is when speculation according to published COT data has returned to bull market values, and the 2015 high in gold prices near $1,300/oz is exceeded to the upside.

HUI is on a new long-term buy signal, ending the sell signal from early 2012. (See chart above).

Long-term signals can last for months and years and are more suitable for the long-term investors.

HUI is on a short-term sell signal. Short-term signals can last for days and weeks and are more suitable for traders.

COT data remains in bear market values, and also below the 2015 high at 1300. Both factors are needed to confirm a new bull market.

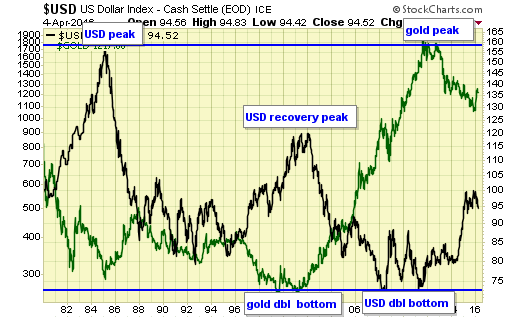

From the long-term perspective, gold and the dollar have always been in an inverse relationship, and that remains today. This chart aided us to consider gold in 2001, and to begin diversifying into USD in 2011.

Jack Chan is the editor of Simply Profits at www.simplyprofits.org, established in 2006. Chan bought his first mining stock, Hoko Exploration, in 1979, and has been active in the markets for the past 37 years. Technical analysis has helped him filter out the noise and focus on the when, and leave the why to the fundamental analysts. His proprietary trading models have enabled him to identify the NASDAQ top in 2000, the new gold bull market in 2001, the stock market top in 2007, and the U.S. dollar bottom in 2011.

Jack Chan is the editor of Simply Profits at www.simplyprofits.org, established in 2006. Chan bought his first mining stock, Hoko Exploration, in 1979, and has been active in the markets for the past 37 years. Technical analysis has helped him filter out the noise and focus on the when, and leave the why to the fundamental analysts. His proprietary trading models have enabled him to identify the NASDAQ top in 2000, the new gold bull market in 2001, the stock market top in 2007, and the U.S. dollar bottom in 2011.

Leave A Comment