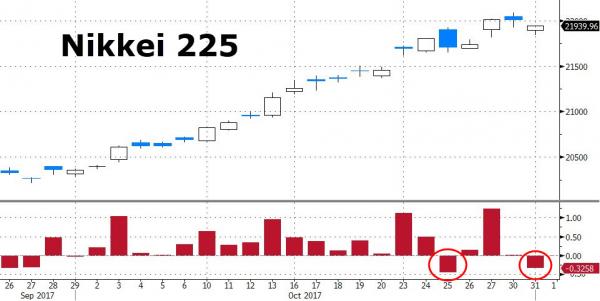

With the Nikkei 225 having only suffered one down day (so far) in the whole month of October (a record), The BoJ decided it’s better not to rock the boat and left monetary policy unchanged, as expected.

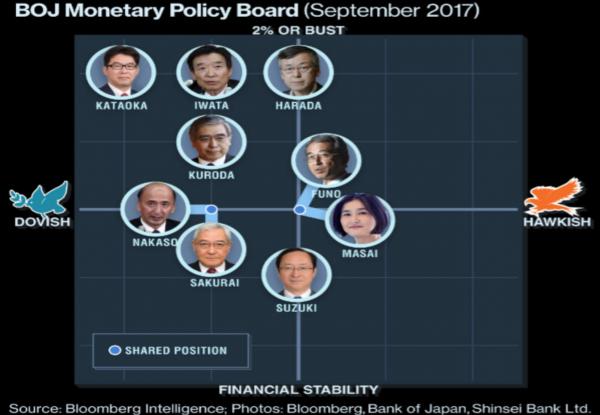

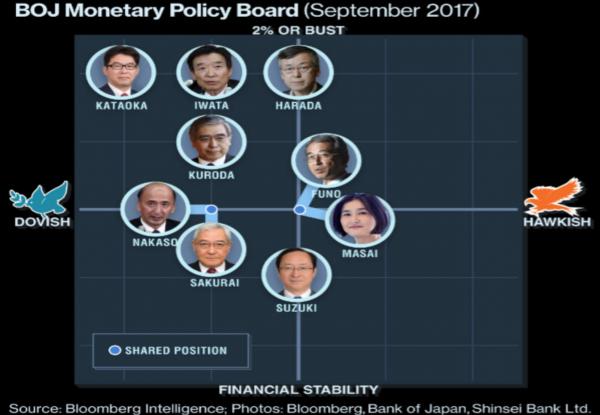

With new members at The BoJ, there was perhaps some uncertainty about Kuroda’s decision today…

Boradly speaking Japanese economic data has been supportive but in recent days, disappointment has begun to set in once again…

But, as expected, The BoJ, hot on the heels of Abe’s snap-election victory, left policy unchanged…

So, no major surprise in those headlines but the inflation downgrade indicates challenges still ahead… and provide an ‘out’ for easing firther if the stock market ever drops.

And the reaction…

October will be the best month for Japanese stocks in 2 years and given today’s weakness so far, there were only two down days in the whole month…

JGB yields remain rangebound and ‘under control’ for now…

BOJ bought 7.74 trillion yen of JGBs in October in its market operations, little changed from about 7.7 trillion yen purchased in September.It has bought about 57 trillion yen so far this fiscal year, after taking into account around 40 trillion yen of notes that are due for redemption in the period. That’s well below the BOJ’s 80 trillion yen target, but the bank has succeeded in its stealth tapering and keep yields generally pinned near zero.

and it appears 114.00 is the limit for USDJPY for now…

Leave A Comment