Description

The Joint Corporation (JYNT) is the largest domestic franchisor and operator of chiropractic clinics. The company aims to provide affordable chiropractic services in this fragmented market using a private pay, noninsurance, cash model. Joint has 900 locations in the USA and plans to open 100-120 newly franchised clinics in 2023.

Overview

With double-digit top line growth, Joint is also undergoing financial and strategic changes. As the largest chiropractic provider, it’s positioned to capture a significant share of this fragmented market. A strong investable opportunity exists due to dramatic oversold conditions, financial improvements, and operational flexibility. Management is committed to selling nonperforming assets, franchising, and reducing expenses.The valuation has materially improved, mainly driven by JYNT’s drop in market value. This price decline is in the face of consistent double digit top line growth. This progress and a decline in the company’s market value creates an investable opportunity. Many low hanging operational levers remain to enhance shareholder value.

A closer look at Q2 2023 reported in September

In Q2 2023, The Joint Chiropractic revenue grew double digit. Yet, management recognizes they needed to make operational changes. To partially address these concerns, Lori Abou Habib was appointed to lead marketing. Joint Chiropractic focuses on short appointments and affordability. This distinct approach attracts new patients. They also emphasize providing treatments like standard adjustments rather than complex clinical diagnoses. And they don’t accept insurance.While JYNT is making internal changes. External accolades from reputable franchise publications and rankings affirm its strong market position. JYNT’s mix of operational flexibility and market recognition suggests undervaluation.Preliminary revenue for Q2 2023 increased by 18% compared to the prior year quarter. Growth improved performance in franchised and company owned clinics. Company owned clinics (+23%) and franchise operations (+11%) drove the revenue increase. Preliminary adjusted EBITDA reached $3.2 million, a 23% increase over the same period last year. Cost control measures such as a hiring freeze, reduced travel expenses and canceled nonessential projects were implemented. Further, the divestiture of specific corporate clinics optimizes productivity and reduces SGA. The financial guidance for 2023 has been revised downward due to changes in accounting, divestiture plans, and economic factors. A renewed focus on cost reduction helps prepare for economic uncertainty and lower revenue expectations.Clinics had a negative 1% decline in sales for clinics operating beyond 48 months. Management expects these challenges to persist in the second half, but options exist to counter them. Their key metrics – new patient count, conversion rates, and attrition – show promise, with attrition and conversion improving. However, their new patient count is slowing. To address this, Lori oversees their marketing efforts, focusing on two key sources of new patients: referrals and local marketing initiatives. 30% of new patients come from referrals. Their clinics cater to those within a 5- to 15-minute radius, and they must educate this local audience about their services. Through traditional means like coupon outreach to schools and gyms.In summary, The Joint faces challenges but is working to overcome them.

Opportunities

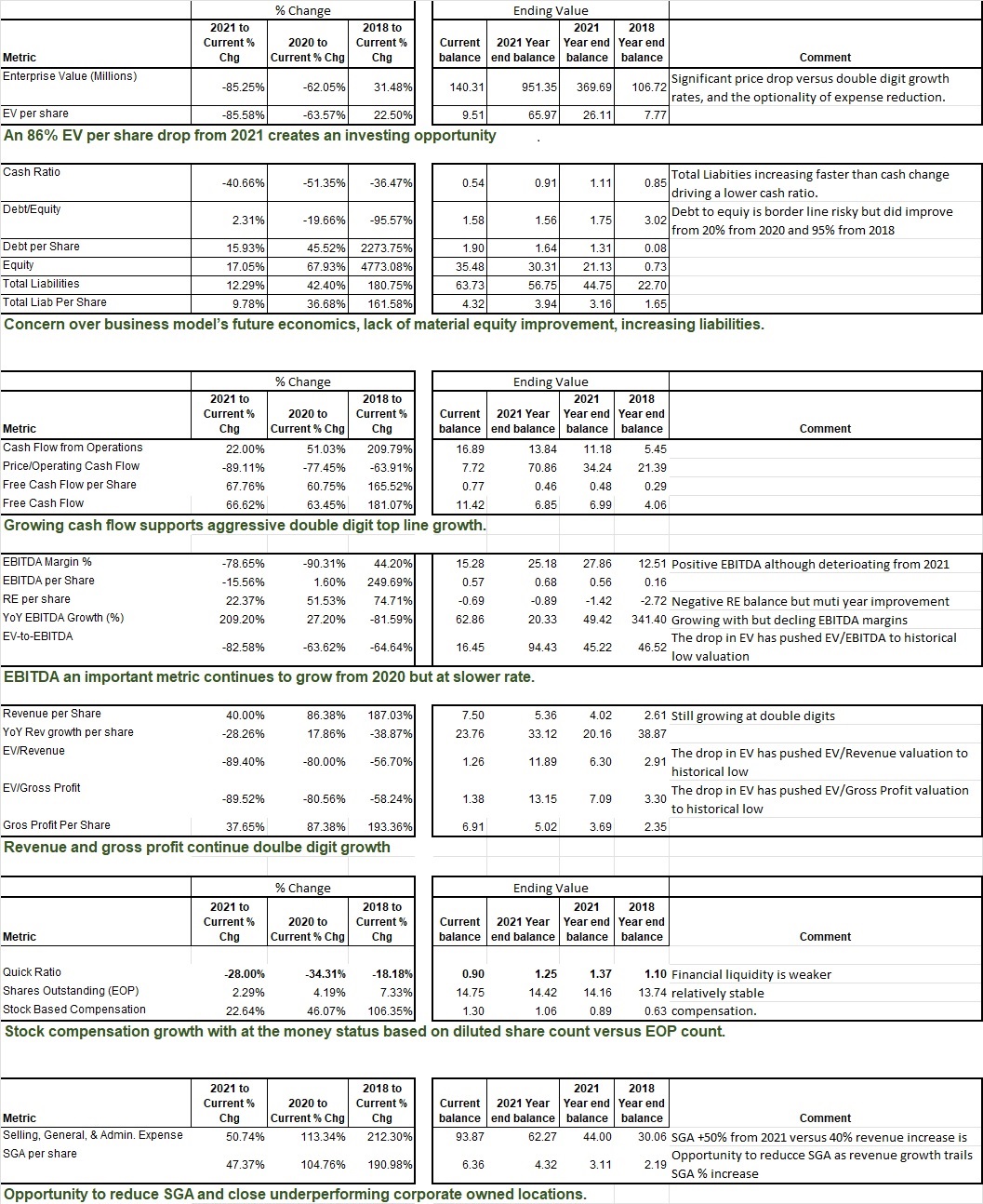

The Joint faces internal (underperforming owned locations) and external challenges (economic/ inflation). But the market undervalues their growth, unique niche, flexibility, operational leverage, financial stability, and mean reversion.The company is transitioning and adjusting its strategy on a large book of business of 111.74M in revenues for the trailing twelve months.Lori Abou Habib was appointed Chief Marketing Officer. Prior to this, she worked at the SONIC Drive-In Franchise Brand. Her franchising expertise complements the refined strategy.The Joint Chiropractic moved up to 52nd on Entrepreneur Magazine’s 2023 Franchise 500 from 57th in 2022. This ranking evaluates cost, growth, and brand strength. The Joint is recognized by Forbes, Fortune, and Franchise Times for its growth and approach. In 2023, it was 18th on Franchise Times’ Fast & Serious list. The Joint was also 1st on Forbes’ 2022 Best Small Companies, 3rd on Fortune’s Fastest-Growing Companies, and consistently ranks high on franchise lists. In 2023, it was named a Top Franchise by Franchise Business Review and was in their 2022 Most Profitable Franchises report.Operating leverage is powerful with little or no costs for each new patient.Aggressive insider buying from Bandera. In 2023, Bandera purchased 1,472,047 shares for $15,476,620 at an average cost of $10.51 per share. In total, Bandera owns 3,937,296 shares, or 26.69% of shares outstanding or 37.28% of float.Mean reverting attributes such as a decline of -86% in EV per share from year end 2021 to today.Valuation ratios have improved significantly. EV/Revenue at 1.26 improved 89% from 2021 amount of 11.89. The Price/ Operating cash flow is 7.72, an improvement from the 70.86 balance for 2021.F score of 8 is a historical high. An increase in the following drove the F score of 8. Positive change in ROA, cash flow return on assets (CFROA) > ROA, positive change in return on assets, cash flow return on assets greater than the return on assets, positive change in working capital ratio, increase in gross margins, positive change in asset turnover. Two points were lost on the F score due to a slight increase in shares outstanding, and a long term debt to average total assets increase.Opportunities for cost reduction. Hiring freezes, selling/closing corporate own locations, reduced travel expenses, and canceled non-essential projects will positively impact the bottom line. These steps are vital in curbing general administrative expenses. SGA per share increased 47.37% from 6.36 for the TTM versus 4.32 for 2021.The Joint is transitioning toward an asset light franchise model. Asset depreciation and cost inflation will improve after the sale or closing of nonperforming corporate owned locations.

Risks

Several factors drive investor’s concern and has a significant short position at 6.26% of the float. In 2021 and 2022, the Joint had to restate its financial statements. And reported a material weakness in their internal controls. Further, implementing updated accounting methods may impact reported earnings. The accounting change is tied to the reacquisition of regional developer rights and transfer pricing. Also, there are concerns about the saturation of JYNT’s clinics in certain areas.Competitors might replicate JYNT’s business model. However, JYNT doesn’t compete with regional or national entities. A short report forecasted a decrease in the company’s stock price. This report negatively influenced the stock price. However, the short report has been challenged as misleading. Skepticism about chiropractic care may contribute to unfavorable stock valuations. There are concerns about new market entrants and regulatory changes.Compared to prior years, stock compensation has grown 23% from 2021, and financial liquidity using the quick ratio declined 28% from 1.37 in 2021 to current balance of .90. SGA per share grew +47.37% from 2021 to TTM versus revenue per share improvement of +40%. JYNT has a promising model. However, increased competition is real if other chiropractors adopt the same business model.

Valuation

A valuation analysis can help determine JYNT’s expected price by analyzing its intrinsic, relative, and historical value.I used a DCF to calculate intrinsic value. It shows a market price slightly above the estimated intrinsic value using historical earnings. But the current market value is significantly discounted if we use average earnings from 2019 to 2021. Also, using free cash flow for a DCF shows a discounted market price to its intrinsic value. Historical earnings have not been consistent or predictable. This lowers the intrinsic estimate compared to using relative and historical valuations.Earnings Power Value (EPV) exceeds the current price. EPV uses current earnings without considering growth. The assumption is the business will maintain its earnings forever, with no growth/change.Using historical multiples like P/E, P/B, P/FCF, P/S, coupled with consistent double digit growth shows JYNT market price trades at a material discount.I believe JYNT’s stock price is trading below its fair market value. For me, this high risk stock is a buy. However, I will add on weakness given the economic challenges and operational changes. Because in the next six months, we won’t see the full benefits of their operational changes.

Conclusion

The Joint Corporation is the largest domestic chiropractic clinic franchisor. JYNT is a risky stock. But, with double digit consistent top line growth, near profitability, and financial stability, the stock is a buy after the irrational 86% decline in EV per share from 2021. Along with that market decline, revenue per share grew 40% from 2021 and 86.38% from 2020. Further, valuation ratios are at historical lows and relatively cheap. Entrepreneur Magazine’s rankings and accolades from Forbes, Fortune, and Franchise Times have recognized the Joint’s accomplishments.With aggressive buying from Bandera, cost-cutting measures and growth, their future looks promising.Don’t forget JYNT is a high-risk stock. Past financial restatements for 2021 and 2020, local market saturation, and weakening financial position present risks. However, the company’s move towards an asset light franchise business model underscores its optionality. While valuation analysis suggests JYNT is undervalued, the full benefits of their recent changes and changes over the next quarter will likely be more visible in the longer term. JYNT is a potentially rewarding investment opportunity.

Supporting data

More By This Author:Alpha Pro Tech: An Intelligent Investment

More By This Author:Alpha Pro Tech: An Intelligent Investment

Spark Networks (LOV), A Risky Value Outlier

Tandy Leather’s Delisting Creates An Extreme Value Opportunity

Leave A Comment