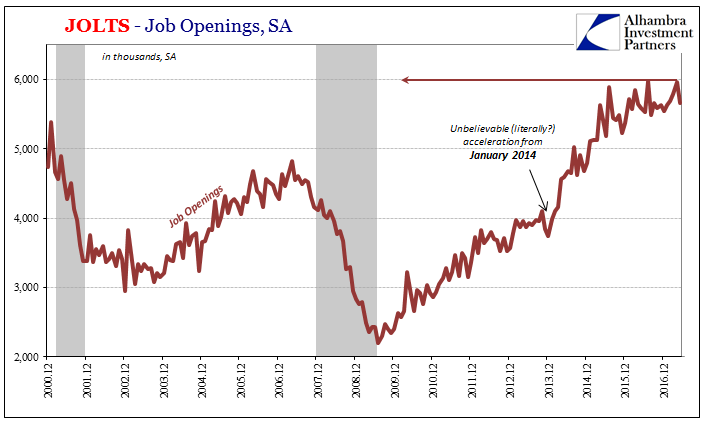

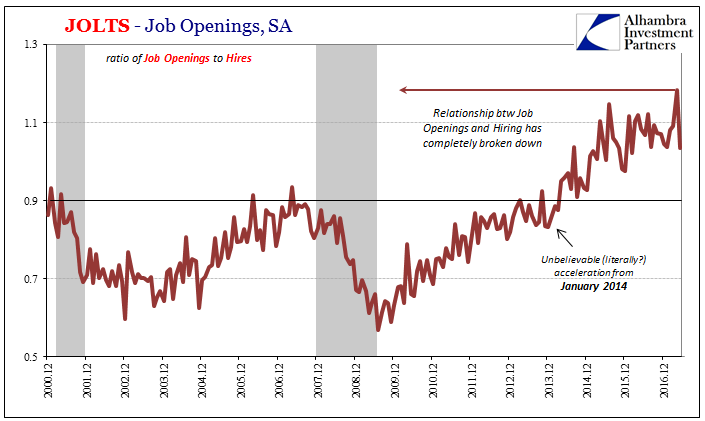

Last month it was Job Openings that soared to a new record high of more than 6 million (for April 2017), while the pace of hiring slammed lower to just more than 5 million. This month (May 2017), the opposite. Hires surged to nearly 5.5 million, while Job Openings fell sharply (and were revised lower for April). The large variations and in opposing directions the past few months underscores what is lingering tension in the JOLTS data.

As with the main payroll reports, whether you are an optimist or pessimist there is data for you. Economists and policymakers have emphasized Job Openings like they have the unemployment rate. Both suggest a blistering pace to the labor market.

On the other side there is like the headline apathy in the labor force of the payroll reports in JOLTS a tepid recovery in hiring. It is made all the more deficient when properly scaling that activity by the level of population growth.

The mere fact of such disharmony, however, argues against the positive viewpoint. A recovery is supposed to be taken literally, whereas that might be the case from the perspective of Job Openings it isn’t even close as estimated by adjusted Hires. The most that might be said of the labor market is that it is advancing, but by how much remains perhaps too open to interpretation.

What is required is corroboration, with the burden of proof shifted to the mainstream view. The unemployment rate, and by association Job Openings, have failed to match economic conditions and therefore have already proved a poor indicator of economic strength/weakness.

The issue currently centers around the breakout in 2014 – without any similar data supporting that idea. Whether spending, wages, or incomes, the notion that the labor market surged wildly three years ago was never supported even in their own category. In other words, though the JOLTS version of Job Openings jumped, other measures of the same thing did not.

Leave A Comment