The recent rout in commodities has not only hurt traders and miners like Glencore GLNCY and Anglo American AAUKF but it has also punished mining equipment manufacturers. Joy Global JOY is one such company. Joy Global manufactures and markets original equipment and parts, and performs services for underground and surface mining. Underground mining equipment is used for the extraction and haulage of coal and embedded minerals. Surface equipment is used for the extraction and haulage of copper, coal, iron ore, oil sands and other minerals.

The company’s fiscal Q3 total revenue was off 2% sequentially from $811 million to $792 million; underground revenue was up 7%, while Surface revenue was down 14%. Operating income during the most recent quarter was $73 million, up 4% sequentially. The company cut operating expenses in response to the decline in its top line. However, it may not be able to cut costs faster than revenue declines going forward.

Wait For $9

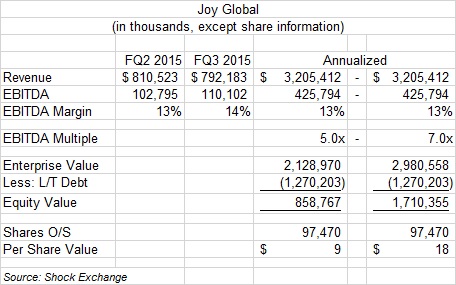

While the shares of miners have declined precipitously due to the free fall in commodities prices and poor balance sheets, I do not believe Joy Global’s share price fully reflects the expected decline in mining equipment sales. JOY trades at $11.81 or nearly 6x its run-rate EBITDA of $426 million. However, I believe the company should trade at closer to 5x EBITDA or $9 per share.

Revenue

The valuation assumes run-rate revenue of $3.2 billion, which is FQ2 and FQ3 results annualized. I believe this is a close approximation of the company’s business prospects. It could be slightly optimistic given revenue is in decline.

EBITDA

Run-rate EBITDA is EBITDA for FQ3 and FQ2 combined, and annualized. This equates to a 13% EBITDA margin, which is consistent with prior periods.

EBITDA Multiple

For cyclical businesses like Joy Global I believe a 5.0x – 7.0x EBITDA multiple is appropriate.

Equity Value

After subtracting net debt (debt less cash and equivalents) of $1.3 billion, I derived an equity value of $860 million to $1.7 billion.

Leave A Comment