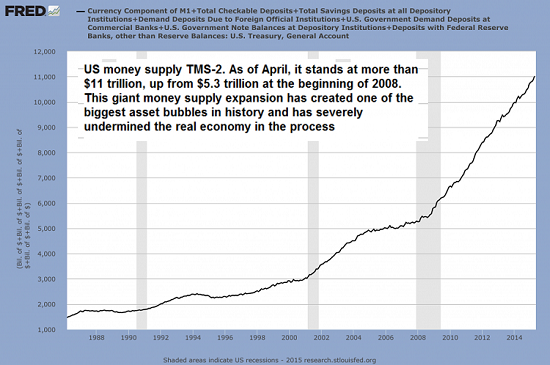

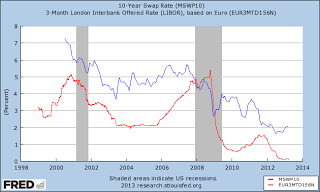

Wow a 25 basis points rise after massive printing of money and unprecedented debt creation. The Global capital markets are now so distorted they are actually celebrating the rise. At least for a day or two but don’t expect the rally

December 16, 2015