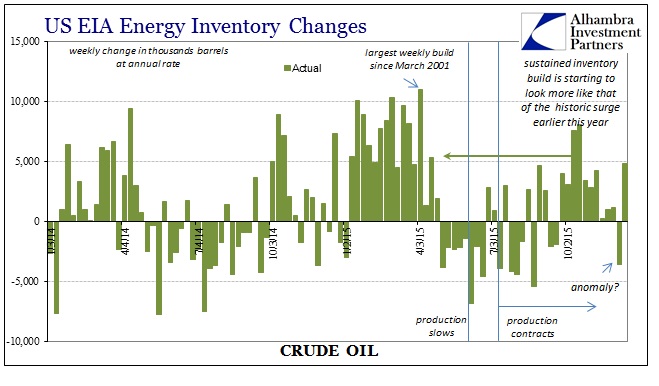

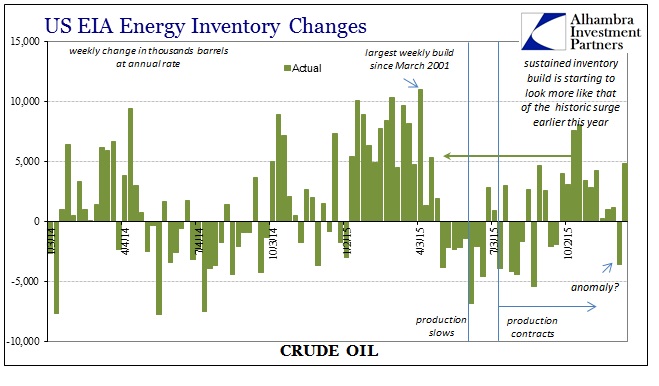

Like industrial production, the condition of oil inventory in the US was updated today in contradiction of the expectations driving Federal Reserve models expecting “transitory” weakness to simply pass into history. Unlike the virtual conditions for the FOMC, crude oil markets are obliged to respect both the eurodollar and the physical realities of physical commodities. Last week, the US EIA reported a significant drawdown of inventories (about 3.5 million barrels) only to find a greater build this week (4.8 million barrels). That leaves the amount of crude oil currently sitting in US storage as basically same as the all-time high registered in April – back when this sort of physical imbalance was last declared so temporary.

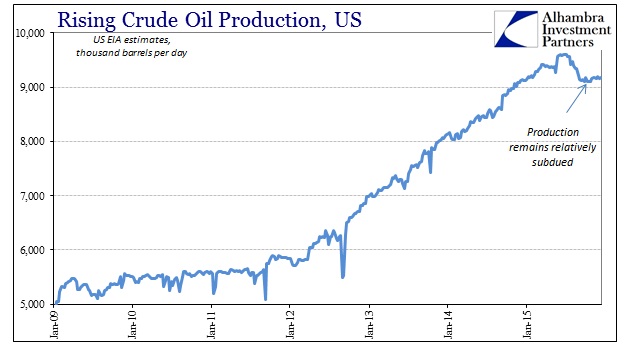

While we hear constantly the drumbeat of supply, the trend in oil production has been entirely predictable; even since summer there is little variability in the trend now at a lower production rate. That leaves but oil demand and usage as the primary variable to have so shifted since last year. While, again, that is being classified as unimportant or “transitory”, somehow it conforms quite well with the disaster in industrial production (energy being a primary input in those segments) now indicating full, economy-wide recession.

More concerning, and placing a great deal more pessimism into the economic mix, is that no matter how low oil prices have collapsed it doesn’t seem to have generated the expected inventory reversal; quite the opposite, the amount of crude in storage appears quite inelastic, as economists reference it, to price. That would seem to violate the basic laws of supply and demand in at least the ceteris paribus manner in which they are analyzed and totaled up as “transitory.” In other words, if the economy was continuing robustly despite the oil slump, those low prices should be quite enough for economic demand to start using much, much more of it. Instead, again, inventories appear inelastic to price which more than suggests that “demand” is weak and weakeningunrelated to the price of oil.

Leave A Comment