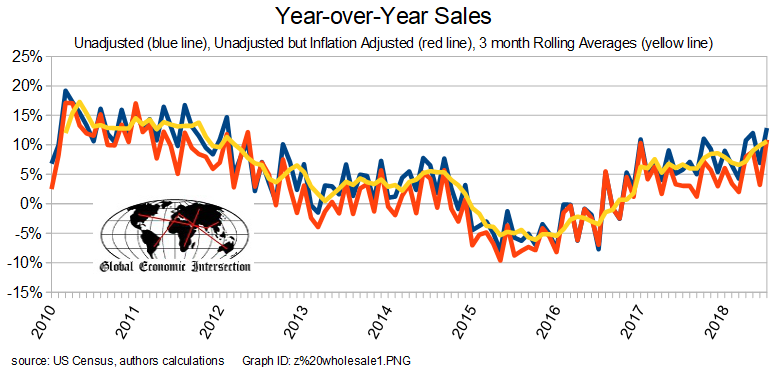

The headlines say wholesale sales were unchanged month-over-month with inventory levels remaining elevated. Our analysis also shows an acceleration of the rate of growth for the rolling averages.

Analyst Opinion of this month’s Wholesale Sales

Overall, I believe the rolling averages tell the real story – and they improved this month. The short-term trends are showing an improving cycle beginning in 2016.

Inventory levels this month are are the high side of normal – but not recessionary.

To add to the confusion, year-over-year employment changes and sales growth do not match.

Note that Econintersect analysis is based on the change from one year ago. Econintersect Analysis:

US Census Headlines based on seasonally adjusted data:

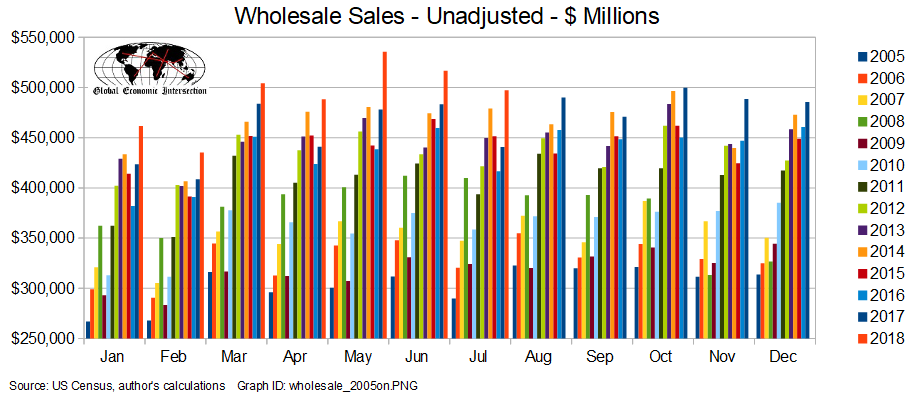

Wholesale sales were at record highs for almost two years – until 2015 where they contracted year-over-year – this contraction ended in 2017. Overall, the inventory-to-sales ratios is slowly returning to normal.

Seasonally Adjusted Inventory-to-Sales Ratio

Leave A Comment