Trump hasn’t started a war. Yet. Other market worries like the French election also turned out to be overblown—so far at least.

We’ve seen some zigs and zags in the past two weeks as the market bought into, then dismissed, then bought into the reflation trade. I remain cautious for both political and economic reasons but I also think we need to be realists. Traders have built such high expectations into this trade that its been overwhelming everything else.

That creates dangers but also opportunity. Some markets saw more selling than I think is deserved. I don’t think a US tax cut/infrastructure program will make much difference to the supply demand balance for zinc or copper or several other metals. You’d never know it from how they trade around events in Washington or Trump Tower tweetstorms though.

That brings me to the extended review this issue which is a zinc developer that is about to IPO. I wanted it in this issue because I have invited them to present at the next MIF and wanted you to have the background before that and before the IPO. I doubt there is much, if any, IPO stock available but the tightness of the deal means it should trade well out of the gate.

***

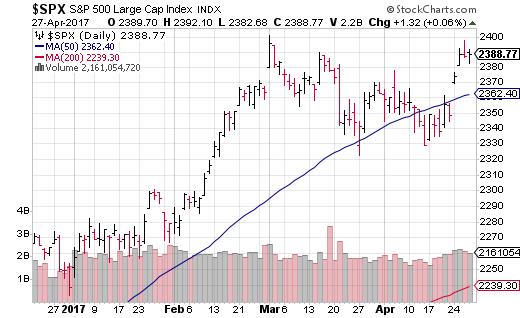

“Thank the French”. There’s a phrase you don’t hear every day. Even so, its fair to say French voters get at least partial credit for turning equity markets around. You can see from the SPX chart below that it was starting to look like we would see a correction in New York. The SPX had dropped below its 50-day average and was seemingly unable to climb back above it.

That all changed in the wake of the French election. The result was as expected but you wouldn’t know it from the size of the swings in many markets that followed it. The size of the moves indicates fear lurking below the surface of an otherwise placid market. It also shows you how little faith traders have in pollsters after Brexit and the Trump election.

The election results were very close to the predictions of several French polling groups. Based on violent moves in the Euro, equity markets and, yes, gold, there were obviously a lot of traders positioned for the worst, just in case.

The two frontrunners face off on May 7th. Are we going to see traders rebuilding “worst case scenario” trading positons in advance of that? It seems hard to believe since Macron is leading Le Pen by over 20 points but I didn’t expect the positioning that took place before last weekend so what do I know.

Some of the biggest moves after the election were reserved for currencies. The Euro had a huge relief rally. I’ve felt the Euro was undervalued for some time as you know. This week’s move brings it back to levels it was trading at just after the US election. There is still some added political risk in Europe but its economy continues to perform well relative to the US. I don’t see a strong reason for the Euro to retreat right now.

Leave A Comment