With price-to-sales at it highest ever for US equities, we thought the following three simple charts may provide some cynical, skeptical, fiction-peddling facts as everyone waits for payrolls this week…

Earnings expectations remain entirely decoupled from equity index price ‘reality’…

And While Industrial Production in America mattered for decades… stocks are ignoring the current recession-like plunge in output…

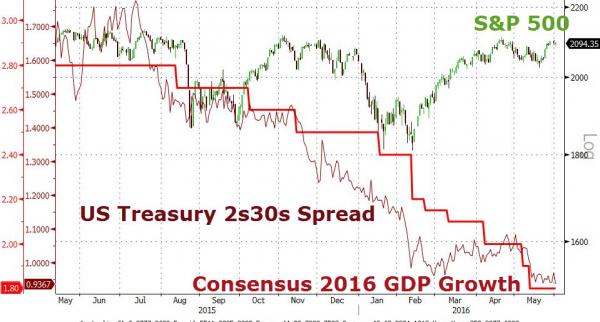

And finally, it appears that bonds (the Treasury yield curve) has a far more accurate sense of reality – as GDP growth expectations collapse – than US equities…

Do you believe in earnings hockey-stick miracles? Is your faith in The Fed unshaken? Can we really get to November’s election without some event? Trade accordingly (and remember VIX shorts and S&P longgs are the highest in years)

Charts: Bloomberg

Leave A Comment