Photo Credit: Mike Mozart

The retail earnings parade is well underway, and results thus far have been rather underwhelming from the discounters to the department stores. Yes, there have been some bottom-line beats from the likes of Wal-Mart (WMT) and Macy’s (M), but top-line strength still isn’t there, and forward-looking guidance is worrisome. Terry Lundgren, CEO of Macy’s, said it best when his company reported yesterday morning … consumers are spending, just not necessarily in the apparel and accessories category. By contrast, home improvement retailer, Home Depot (HD), had a spectacular Q4, prompting an increase in its quarterly dividend and strong 2016 guidance.

So that brings us to Kohl’s, (KSS) which sits somewhere at the lower-end of the department store segment. It’s not quite as high-end as Macy’s or Nordstrom, but not a discounter like Wal-Mart or Target either. This puts Kohl’s in a unique and potentially beneficial position. Consumers certainly have more money in their pockets due to lower oil prices, but they are more value-driven than ever, likely the cause of stagnant wage growth. There is also validity to what Mr. Lundgren said, consumers would rather allocate discretionary income to technology and big ticket items like autos and appliances, and save on apparel items.

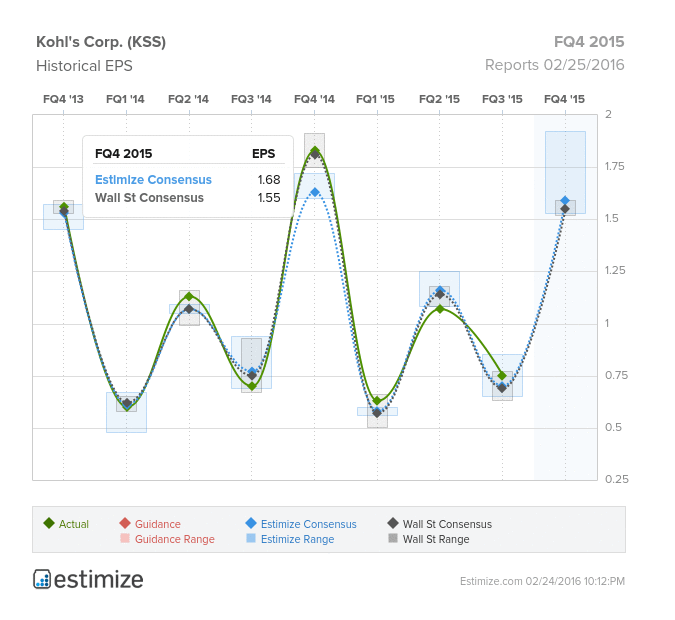

For the fourth quarter, reporting tomorrow, the Estimize community is currently looking for Kohl’s to report EPS of $1.69, that’s 14 cents ahead of Wall Street. However our Select Consensus, a weighted average of the most historically accurate analysts and most recent estimates, is showing a slightly more modest beat of 4 cents. Revenue expectations are roughly in line at $6.4B. No matter which EPS metric you’re looking at, this suggests a YoY decline in profits of at least 6%, while revenues are anticipated to increase 1%.

Earlier this month, Kohl’s warned that the holiday season hadn’t gone as well as it wanted, something we’ve been hearing from many retailers. Like others, KSS had to offer deep discounts in order to clear inventories and compete with peers. Seasonably warmer weather throughout the quarter also disrupted sales of higher margin winter apparel such as coats and boots. As a result, Same Store Sales for the fourth quarter came in at a meager 0.4%, below analysts estimates for 1.2%. Even so, this is still much better than peers such as Macy’s and Nordstrom who each reported negative comp sales.

Leave A Comment