Greece – Ground Zero in the War on Cash?

We believe it was our friend Claudio Grass of Global Gold in Switzerland who first mentioned that the eurocracy may possibly have plans to use the Greek crisis as an opportunity to expand the ongoing war on cash. It stands to reason: Greece is well known for its extremely large “shadow economy” (the name for economic activity that flies under the radar of the greedy grasp of the State). Greece’s citizens not unreasonably regard the State as akin to a mafia organization which they are trying to avoid as much as possible (unless it promises them free goodies to buy their votes – they do of course gladly accept those).

We vividly recall an interview with a Greek shipping magnate about the constitutional provision that has relieved the country’s shipping industry from income tax. The interviewer asked (we are paraphrasing) whether the magnate thought it “fair” that this was so, and if he wasn’t troubled by his conscience in light of the Greek government debt crisis. The shipping magnate replied (again paraphrasing) along the lines of: “Just look at the government in Athens. They’re nothing but a bunch of crooks. Would you hand over your money voluntarily to Al Capone? Surely not. Well, neither do I.”

Not someone you want to hand your money to…

Photo credit: Bettmann / Corbis

A great many ordinary Greeks undoubtedly agree with the shipping magnate. They have a very cynical, but ultimately quite well-informed view of the political class and the State. The reason why the Greeks are way ahead of most other European citizens in this department is rooted in history. Greece had been under Ottoman occupation from the 15th century until 1821. The so-called millet system led to the Orthodox Christian Greek community remaining a fairly cohesive group. However, the Greeks certainly chafed under Ottoman rule.

The occupation caused two waves of migration. In the first, many fled to Western Europe, in the second many fled from the plains to settle in the mountains. Greeks who remained in the plains either had to put up with the disadvantages of the Ottoman apartheid system, or they became so-called “crypto-Christians” – people pretending to convert to Islam, while secretly remaining Christians. Needless to say, the Greeks deeply resented the Ottoman State and its bureaucracy, developing a healthy disrespect for the State in general in the process.

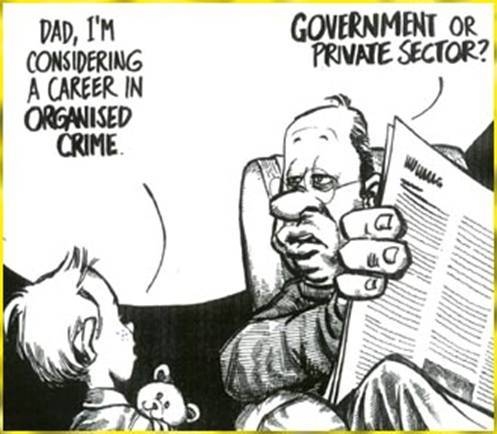

The view of the nature of government encapsulated in this timeless cartoon is widely accepted in Greece.

The Legal Fiction of the “Demand Deposit”

The eurocrats recently brought the Syriza government of Alexis Tsipras to heel by reminding Greece that its fractionally reserved banking system is in fact insolvent. This becomes glaringly evident as soon as the backstop provided by the central bank and its unlimited money printing powers is removed. That is all the ECB ultimately did – by refusing to increase the provision of ELA (emergency liquidity assistance) to Greek banks, the latter were no longer able to pay depositors who attempted to withdraw their own money. Nota bene, this money was contractually promised to be available to them “on demand”, this is to say, anytime they wanted it.

Demand deposits are of course little more than a fraudulent legal fiction in a fractionally reserved banking system. Banks are actually not warehousing the money given to them by depositors. The nature of the demand deposit contract is in fact quite different from what one would normally expect, based on common sense alone. The money paid in is simply not there, as it is immediately used for the bank’s own business purposes. In effect, the fractionally reserved system creates legal claims on the same amounts of money that are held by several persons at once.

Circularity

In no other industry would the courts accept such a legal absurdity without demur. Indeed, from antiquity to the early middle ages bankers would quickly lose their heads over such fraudulent business practices. This changed the moment the State got in on the scam, upon realizing that it could use it for its own purposes – primarily the financing of warfare (and later welfare as well), by means of theft by inflation.

Leave A Comment