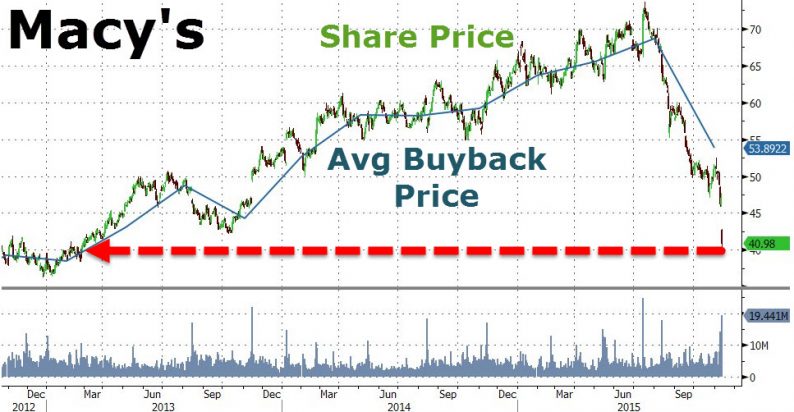

Macy’s is down over 13% today, pushing towards a sub-$40 handle – the lowest since February 2013 – after lowering guidance and disappointing a market full of hope (and hype) that retail is back (remember, all the retail hiring last Friday). However, that is not the most prescient issue as 3 years of buying back billions of dollars of Macy’s stocks – to financially-engineer earnings to ensure executive compensation is satisfactory – have been completely wasted. And worst still, the additional debt added to fund the total failure in timing of buybacks has now sent Macy’s credit spiking to multi-year highs (as the stock tumbles).

“No Brainer” – Macy’s actually increased their buyback pace last quarter alone – spending $900 million on stock at an average price of $53.89, a loss of $230 million of that “investment”

And the flipside of shareholder-friendly releveraging… spiking default risk…

Now what? This is the clear message that executives in every credit cycle – there is a limit to the largesse with which you can abuse bondholders in the name of levitating share prices amid a dismal reality.

to financially-engineer earnings to ensure executive compensation is satisfactoryBloomberg has all the evidence you need. Here’s more:

As BloombergView followed up today, there is simply no question who really benefits in the end from management’s exuberant buybacks: Why Management Loves Buybacks

According to RAFI’s study, U.S. companies issued stock equal to $1.2 trillion last year. All told the new issues in 2014 exceeded share buybacks.

The RAFI study also found that “the cash flow statement often fails to report the majority of a company’s stock issuance.” Much of that unreported issuance is used as compensation for employees, primarily management. “When management redeems stock options, new shares are issued to them, diluting other shareholders” the report further notes. “A buyback is then announced that roughly matches the size of the option redemption. This facilitates management’s resale of the new stock.”

The conclusion is that what looks like buybacks are actually thinly veiled management-compensation plans, or in RAFI’s words, “simply a mirage.”

Leave A Comment