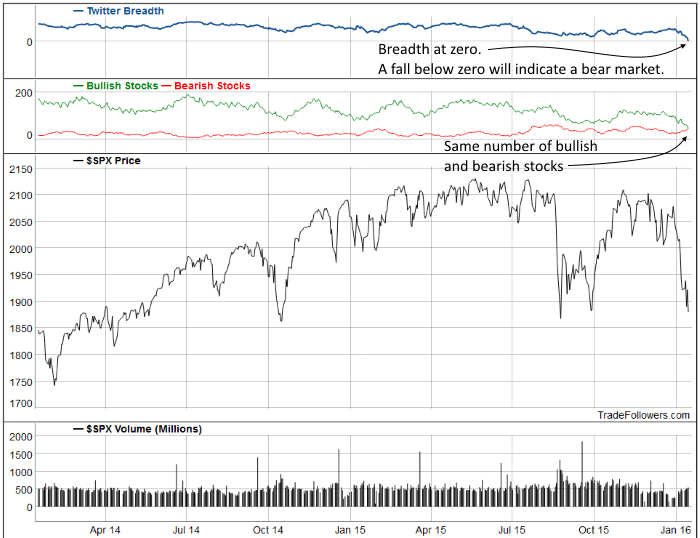

I did a post at Downside Hedge that shows several market indicators that are very close to signaling a bear market. The market needs to recover very soon or the long term trend will be changing from bullish to bearish. One of the indicators I highlighted was breadth between bullish and bearish stocks on Twitter. It is sitting at zero right now. A fall below zero will indicate a bear market. Read the full post a Downside Hedge for more info.

A few charts I didn’t include in the other post are 7 day momentum and intensity. 7 day momentum for the S&P 500 Index (SPX) is turning down from below zero. That’s never a good sign.

The volume and intensity of tweets is rising to a level that generally marks a short term low. But, if we’re in a bear market that behavior may not generate a significant bounce.

Leave A Comment