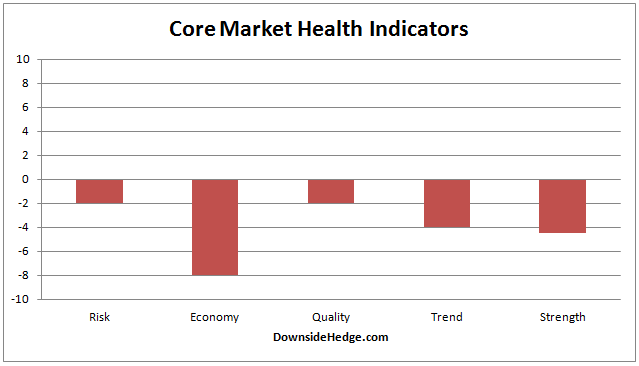

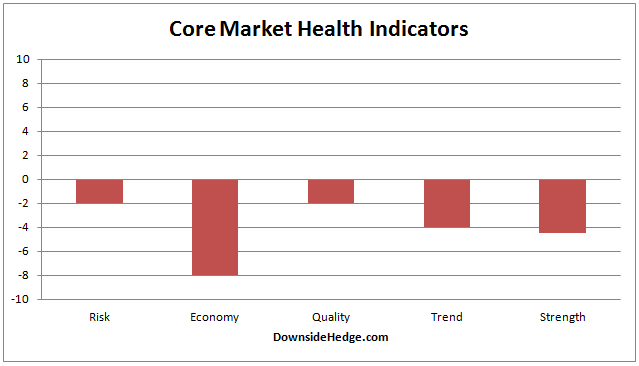

Almost all of our core market health indicators improved over the past week, however none of them could get back above the zero line. If the market can continue to climb it looks like our measures of risk and quality could clear by next Friday. The problem I see is that we’re due for a bit of consolidation so the nature of the next dip will be extremely important. A very healthy sign would be for our indicators to continue to rise in the face of falling prices.

Here is a chart of our health indicator categories. Since they’re all below zero our portfolios are either fully hedged or in cash.

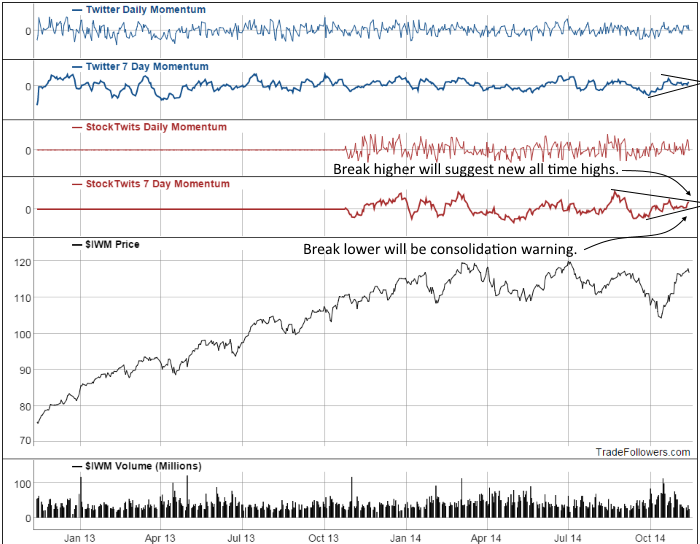

One thing I’ve been watching closely for the last several weeks is the performance of small caps (IWM). They should either break upward to new highs or consolidate fairly soon. I want to see any dip muted as a sign that the worst is behind us.

Leave A Comment