This up trend that started with the election has been broken. Does that mean that we have a medium-term correction developing? It isn’t too convincing yet, but it is a start.

Technology is taking a well deserved break. There should be a good buying opportunity sometime in the weeks ahead.

Junk Bonds aren’t cooperating for the bears. This chart looks more likely to go up than down.

The people who suggested buying Energy for the bounce turned out to be right. But it isn’t my style. I’d rather trade with the trend, so I would be a seller if it touches the top of this channel.

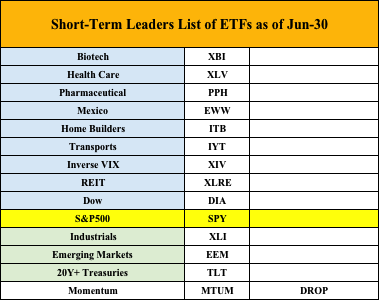

The Leader List

Momentum Stocks dropped off the short-term leader list. The Financials still haven’t been added.

This is not a great looking chart. The recent price action is good, but it really is a wide and sideways range going back six months.

I think this chart of the Gold Miners is headed lower, but the weekly price needs to close below this support level to confirm. I’m a seller of the Gold Miners after getting burned on a failed break out a few weeks ago.

Semiconductors are finally correcting. The next support is at 130 or so.

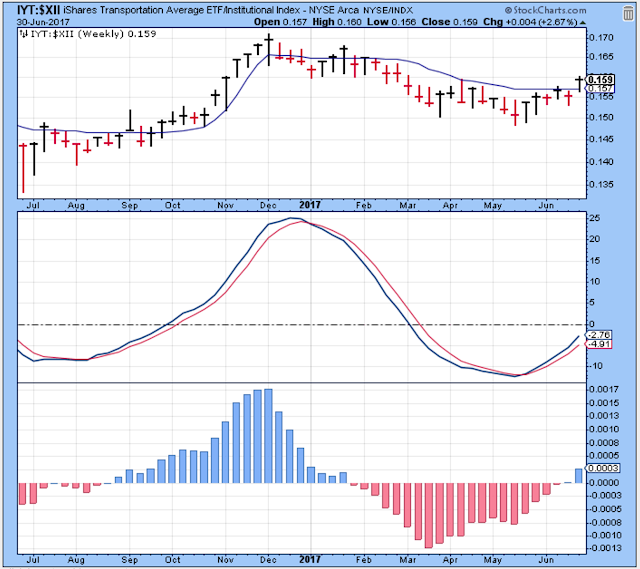

The Transports are looking good at the moment, but I’m not a buyer yet because the overall market worries me.

Outlook

The long-term outlook is positive.

The medium-term trend is under pressure and might be topping out.The short-term trend is down.

Leave A Comment